On Wednesday, May 22, the UK CPI data will be released. This CPI print is in a major focus as investors want to know whether the Bank of England is winning the inflation battle. A surprise print to the upside or the downside is likely to send the GBP on a sharp move, but how much of a move can be expected?

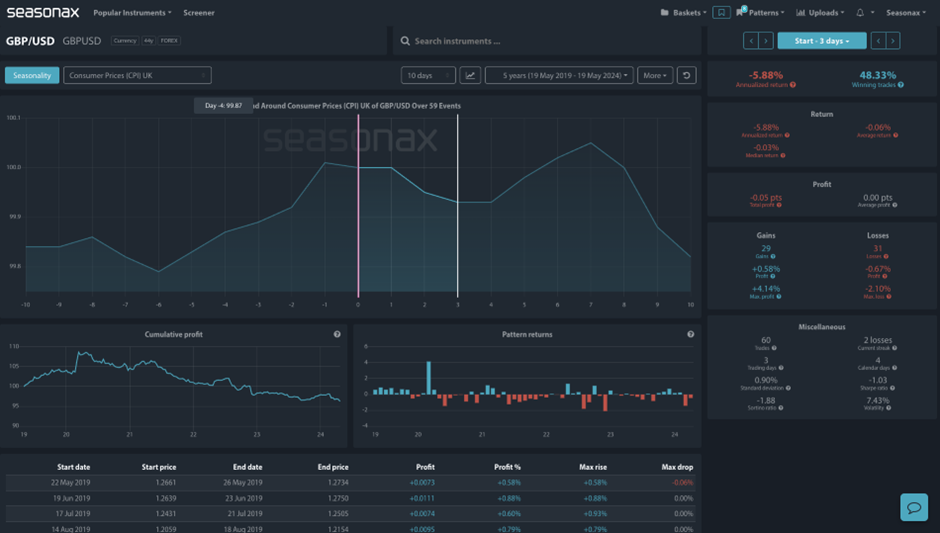

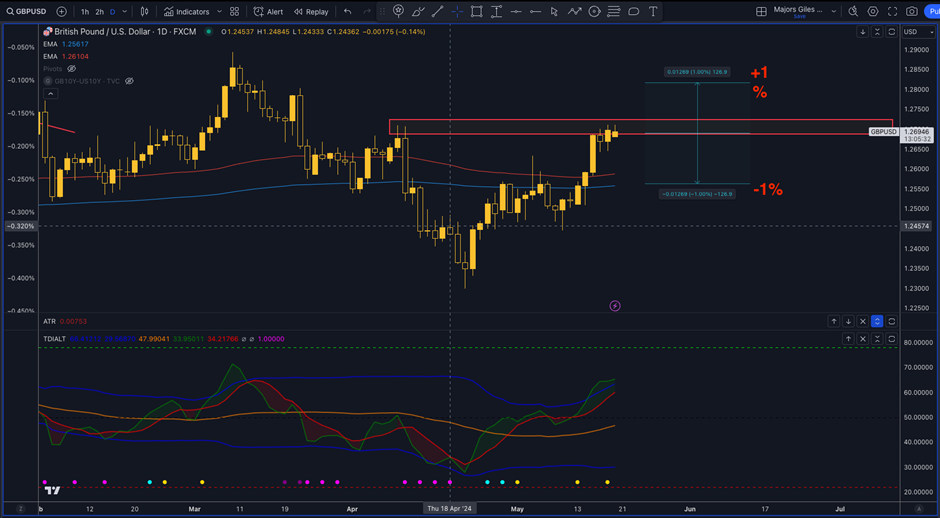

This is where Seasonax’s event screener is so helpful. Over the last 5 years of CPI print we can see that the largest move, on the close, after 3 days has been 4.14% to the upside and 2.10% to the downside. The maximum gain has actually been as afar as 4.80% and the maximum fall 2.26%. There has also been a fair few moves of +1% or -1% during this period as well. So, if we do get a surprise print this can help set expectations of what targets may be realistic.

Giles Coghlan, CMT is a seasoned financial writer specialising in macro outlooks and key technical trading strategies

Sign up here for thousands of more seasonal insights just waiting to be revealed!

The major trade risk here is that the CPI release is as expected and volatility is muted.

Remember, don’t just trade it Seasonax It!