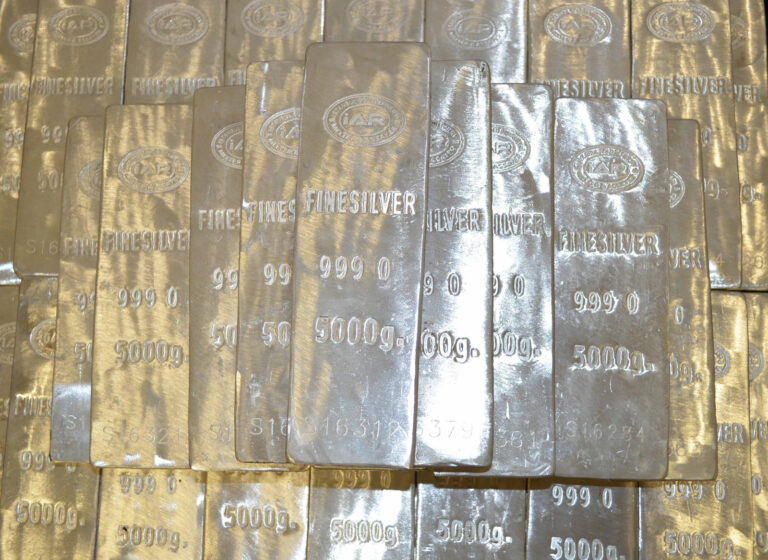

Gold has gained 50% in the past two years, although this is scarcely noticed by some investors. This year it was one of the best asset classes.

You may be wondering therefore how gold producers and precious metal miners fared in this favorable environment.

The answer: not so well, so far. Over the course of two years, they rose by just 35%, less than the precious metal itself.

Is it now time for it to catch up? Let’s look at the answer that seasonality gives.

Newmont Mining over the course of the year

Newmont Mining is the largest gold mine in the world and therefore the standard value of this sector. At the end of October, slightly worse results than expected caused Newmont Mining’s share price to fall excessively. This makes the stock currently look cheap, which caught my attention.

So let’s look at seasonality. The chart below shows you the seasonal development of Newmont Mining over the past ten years. The horizontal axis shows the point in time in the year, the vertical axis shows the average trend of the share price returns. This way you can see at a glance how Newmont Mining typically runs seasonally.

Newmont Mining, seasonal trend over 10 years. The seasonal increase begins at the end of November. Source: Seasonax

As you can see, there is a pronounced seasonality of Newmont Mining.

I have marked the best phase for you with arrows. It starts on November 27th and ends on April 11th.

The strong phase is now!

During this period, between November 27th and April 11th, Newmont Mining rose an average of 24.04%, which corresponds to an annualized rate of 78.88%. The hit rate has been 100% over the past ten years, meaning Newmont Mining rose every year during its best season.

For comparison: In the remaining period from April 11th to November 27th, Newmont Mining lost an average of 13.35%.

This big difference of +24.04% to -13.35% shows you how good the upcoming seasonal phase is at Newmont Mining.

Seasonality helps increase profits!

Newmont Mining, like other mines, has underperformed gold over the past two years, and is therefore generally a promising candidate for strong increases.

Additionally, Newmont Mining now has excellent seasonality.

Due to the combination of “lagging behind gold” and “good seasonality”, consider the stock to be very promising.

How do you see this? Or do you prefer other mines or other sectors?

Whatever your market opinion: With Seasonax you can examine stocks from all sectors for good seasonal phases!

Kind regards,

Dimitri Speck

Founder and Chief Analyst of Seasonax

PS: I’ll be delighted if you make profits in your favorite sectors with Seasonax!