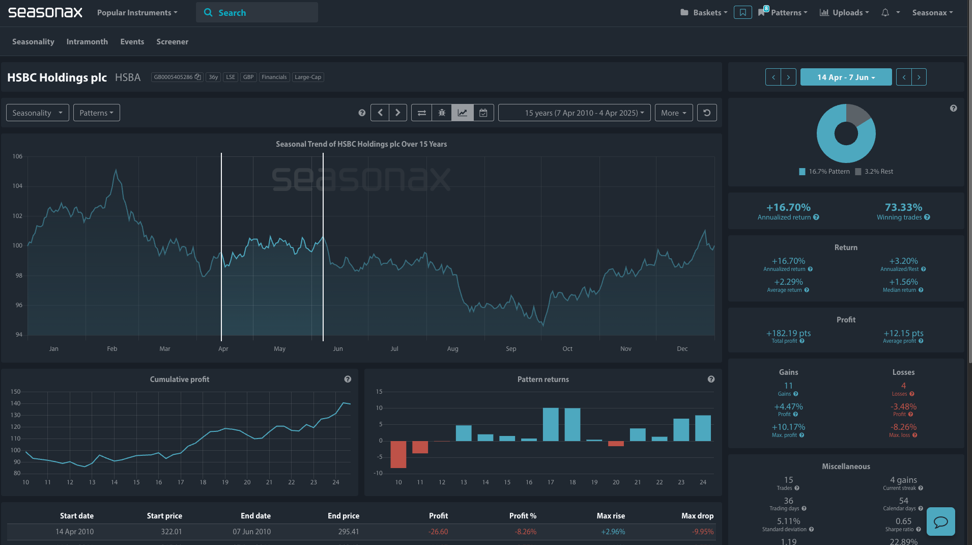

- Instrument: HSBC Holdings plc

- Average Pattern Move: +2.29%

- Timeframe: April 14 – June 7

- Winning Percentage: 73.33%

Dear Investor,

You may have heard that HSBC shares have come under pressure amid renewed US-China trade tensions, but could history suggest there may be a silver lining for patient investors. With a strong seasonal pattern emerging just as geopolitical stress hits the headlines, we want to analyze the data in more detail.

The chart shows you the typical development of HSBC’s share price between April 14 and June 7 over the past 15 years. During this period, HSBC shares have risen 73.33% of the time, with an average return of +2.29%, a median return of +1.56%, and an annualized return of +16.70%. The cumulative profit line is impressively consistent, pointing to a resilient spring-summer trend.

A Deal Could Flip the Narrative

The latest leg lower in HSBC has been triggered by concerns that their pivot to Asia has left them acutely exposed to fallout from a renewed US-China trade war. HSBC shares dropped roughly 16% in Hong Kong trading on Monday last week as markets priced in tariff risk and slower regional growth.

But is this type of sharp move an over reaction?If the US has a change of heart on the direction of tariffs, could this end up stimulating global trade once again.

Investors may begin to revisit the long-term appeal of HSBC’s Asia exposure, especially if easing trade tensions are accompanied by signs of Chinese stimulus or stabilization in global risk sentiment.

Technical Perspective

From a technical standpoint 47 and 42 offers strong monthly support and will be key technical areas of support to note.

Use Seasonax for your professional handling of market-moving events!

Sign up here for thousands more seasonal insights waiting to be revealed!

Trade Risks:

The seasonal trend for HSBC shares is constructive, but the US tariff decisions introduce headline risk. A breakdown in negotiations or further escalation in US-China tensions could trigger continued outflows from EM-exposed banks. Investors should also monitor broader risk sentiment and regional macro data before stepping in.