On Friday March 10 the US will release it’s jobs report for February.

In the Fed’s thinking a ‘tight’ (strong) labour market is inflationary. So, if the jobs print comes in above 325K and average hourly earnings above 4.8% the Fed will see that as signalling more work to be done and that will raise expectations of a 6% terminal for the fed.

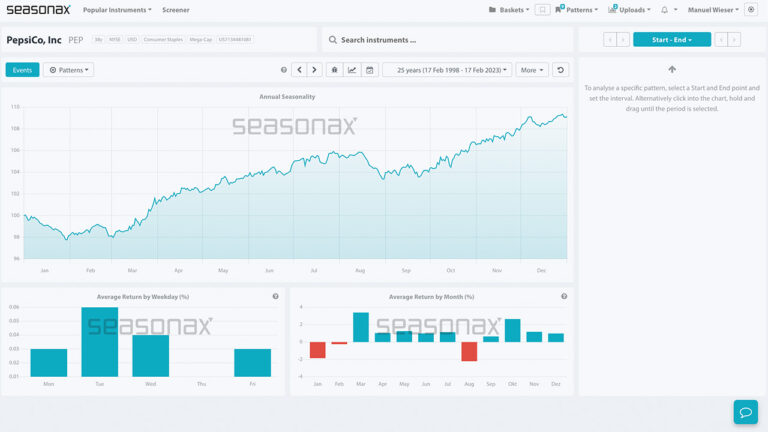

However, the best opportunity for gold, the USD, and stocks would come from a big miss in the data! Taking a look at the reaction of gold over the US Labour Report we can see that gold has a tendency to push higher in the 3 days after the jobs report. So, would a big miss on Friday jobs data give gold traders a good short term opportunity in buying gold?

Major Trade Risks:

The major trade risk here is If there is another strong jobs report which would naturally support the USD, yields, and weigh on gold.

Remember, don’t just trade it, but Seasonax it!