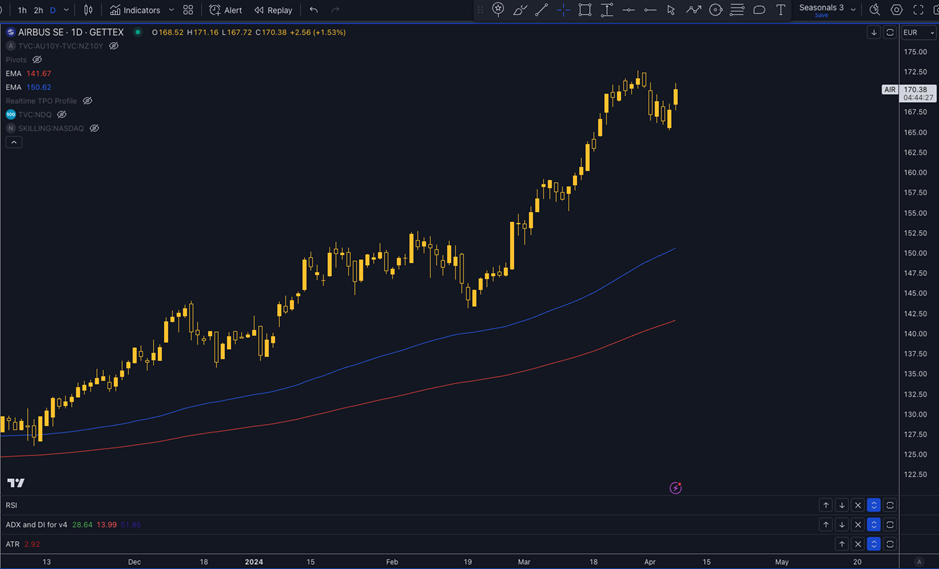

Boeing and Airbus have historically been the two largest commercial aircraft manufacturers globally, with Boeing dominating the North American market and Airbus having a significant presence in Europe and other parts of the world. Changes in market share or new aircraft orders can affect their stock prices. At the moment, the serious manufacturing issues plaguing Boeing has resulted in upside for Airbus shares. See the strong gains the stock has been making below.

The seasonal pattern for Airbus is also very strong at the moment and with Boeing struggling to shake off their manufacturing woes, can Airbus find dip buyers? Over the last 20 years Airbus’ share price has risen 70% of the time with an average return of 4.17%. The largest gain has been nearly 40% in 2020 and the median return has been 5.25%.

Sign up here for thousands of more seasonal insights just waiting to be revealed!

The major trade risk here is that new emerging trends in the aerospace industry, such as demand for new aircraft, technological advancements, environmental regulations, and competition from emerging markets, can influence the stock prices of both Boeing and Airbus.

Remember, don’t just trade it Seasonax It!