Currency strategists are increasingly bullish on the Japanese yen following the Bank of Japan’s (BOJ) interest rate hike in July and the Federal Reserve’s signal of upcoming rate cuts. Previously, many experts expected the yen to weaken further after a significant decline in the first half of the year. However, the outlook has shifted due to a potential narrowing of interest rate differentials between the U.S. and Japan.

The Fed’s likely move to cut rates, as indicated by Chair Jerome Powell at Jackson Hole, contrasts with the BOJ’s signals of possible further rate hikes. This shift from policy divergence to convergence supports the yen’s strength. Major financial institutions, including Macquarie and Standard Chartered, have revised their year-end forecasts, now predicting a stronger yen.

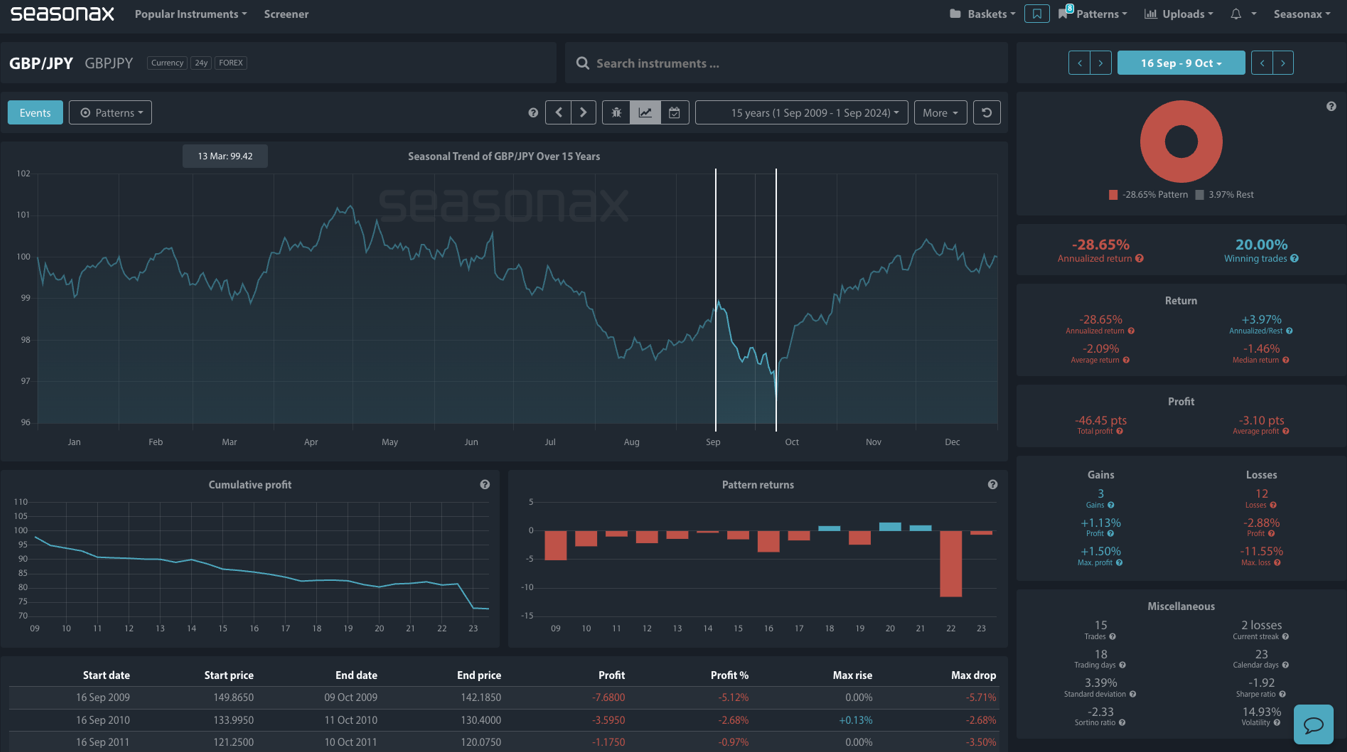

The yen’s recovery from its recent lows has disrupted global carry trades and could impact Japanese exporters. With the BOJ expected to tighten policy further, and the BoE likely to cut rates, the yen is poised for continued strength, especially if UK (and US) economic data weakens. Seasonally there is a very weak period ahead for the GBPJPY with falls 13 times in the last 15 years between September 16 and October 09. Does this make the GBPJPY attractive for potential shorts?

Technically, the GBPJPY monthly chart shows a strong hammer reversal bar on the monthly chart, which promises a potential return to 200.00. The question is, ‘will sellers re-enter on higher prices?’. If they so the 200-204 region would be a great place for sellers on further JPY strength if it materialises in the second half of September – it is one chart to watch carefully!

Sign up here for thousands of more seasonal insights just waiting to be revealed!

Trade risks

- The main risk here is down to incoming data that will impact both the Bank of Japan, and Bank of England’s decisions, which in turn will impact the direction of the GBPJPY pair.

Remember, don’t just trade it Seasonax It!