Microsoft shares have drifted lower since their last earnings report, despite beating on the headline print for both their EPS and revenue. If the slide in shares continues where will dip buyers step in? Around the $220 mark?

One thing that dip buyers might want to note is that the seasonals for Microsoft are very strong right now.

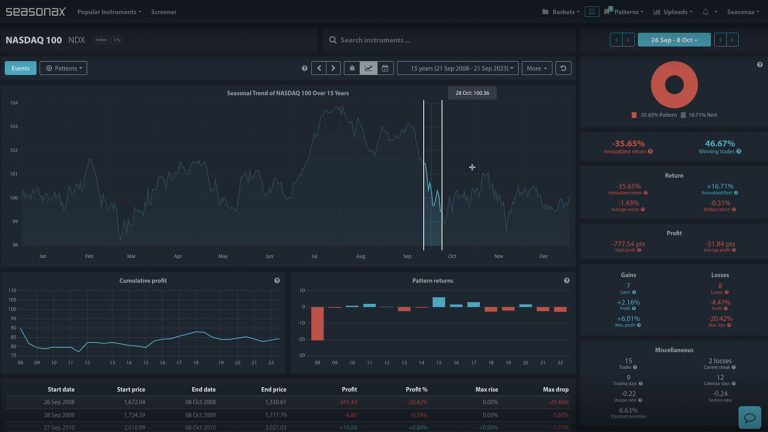

Over the last 10 years Microsoft has not lost value once between May 23 and July 17. The average return has been +6.92% and the maximum return has been over 10% at 11.74%.

Does that mean Microsoft shares will gain again this year? Not necessarily, but these seasonals are worth at least being aware of.

Major Trade Risks:

- Any bad news for Microsoft stock would negate this outlook.

- A US recession would also impact the positive outlook for Microsoft’s share prices

Analyse these charts yourself by going to seasonax.com and get a free trial! Which stock would you most like to investigate for a seasonal pattern?

Remember, don’t just trade it, Seasonax it !