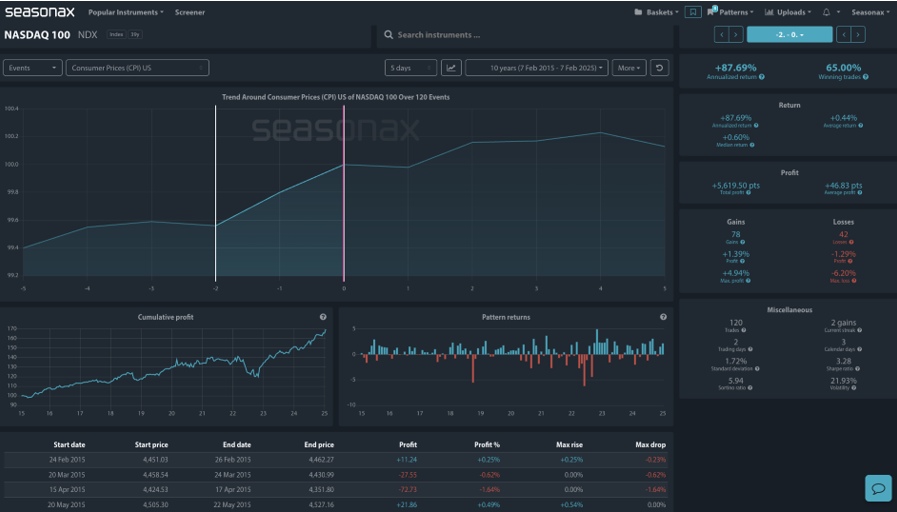

- Instrument: Nasdaq

- Pattern Move: 87.69% annualized return

- Timeframe:2 days before CPI release

- Winning Percentage: 65%

Seasonal Risk Event Strength

The upcoming US CPI print on February 12th is set to be a crucial driver for market sentiment, especially for rate-sensitive assets like the Nasdaq 100. Recent inflation expectations, as seen in the latest University of Michigan (UoM) consumer sentiment report, have surged—1-year inflation expectations jumped to 4.3% from 3.3% prior. This sharp increase is largely driven by political uncertainty, as concerns around fiscal policy, trade, and election-year volatility weigh on consumer sentiment. Also, there was a very sharp distinction in inflation expectations between Republican and Democrat voters with Republicans seeing no extra inflation and Democrats seeing an inflation surge! With Fed Chair Powell speaking later the same day, the Nasdaq faces a potential double impact from both inflation data and subsequent rate guidance.

The Nasdaq 100 is inherently rate-sensitive, as its valuation is heavily influenced by interest rate expectations. Higher CPI readings can push rate expectations higher, pressuring equities—particularly high-growth tech stocks that derive much of their value from future earnings. The key dynamics at play:

- Higher-than-expected CPI: Markets may repricing rate cut expectations for 2025, weighing on the Nasdaq.

- In-line or lower CPI: Could reinforce Fed dovishness, fueling risk-on flows into tech stocks.

- Powell’s speech: If the Fed pushes back on early rate cuts, expect volatility in tech-heavy indices.

Seasonality Favors the Nasdaq Post-CPI

Despite potential short-term turbulence, seasonal trends suggest a strong upside bias for the Nasdaq following CPI prints. Historical data over the past decade reveals a consistent positive drift in the index into CPI events. Over the last ten years, the Nasdaq has exhibited an +87.69% annualized return around CPI releases, with a 65% probability of positive returns in the following sessions. Additionally, cumulative profit trends show a steady post-CPI recovery, aligning with the broader Q1 bullish seasonality. This data strengthens the case for gains ahead of the CPI release and a tactical Nasdaq rebound post-CPI volatility, provided inflation prints in line or below expectations.

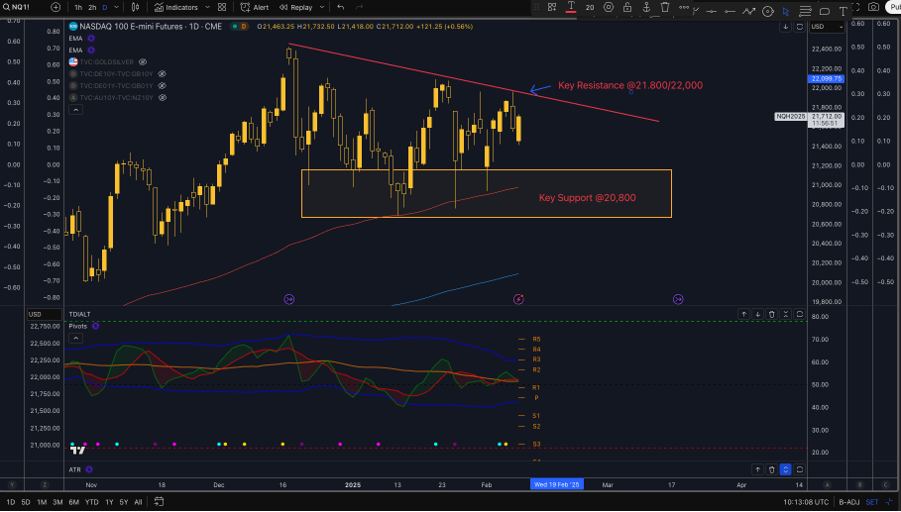

Technical Perspective

The Nasdaq 100 is facing key overhead resistance at 21,800–22,000, where sellers have consistently emerged, forming a descending trendline. A breakout above this level could trigger bullish momentum. On the downside, key support sits at 20,800, aligning with prior demand zones and the 200-day EMA, making it a critical level to hold in case of a pullback.

Final Thoughts: Navigating the CPI Event

Key focus: Watch CPI numbers and how they shift rate cut pricing for 2025.

With elevated inflation expectations and a crucial Fed speech, markets will be looking for confirmation that inflation remains on a controlled path. The Nasdaq, while vulnerable to CPI-driven rate moves, maintains a historical seasonal edge that favors buying the dip post-CPI volatility.

Sign up here for thousands more seasonal insights waiting to be revealed!

Trade risks

Short-term risk: Hot inflation = Nasdaq pressure; a cooler print = potential upside catalyst.Watch for Powell’s speech on the same day.

Don’t Just Trade It – Seasonax It!