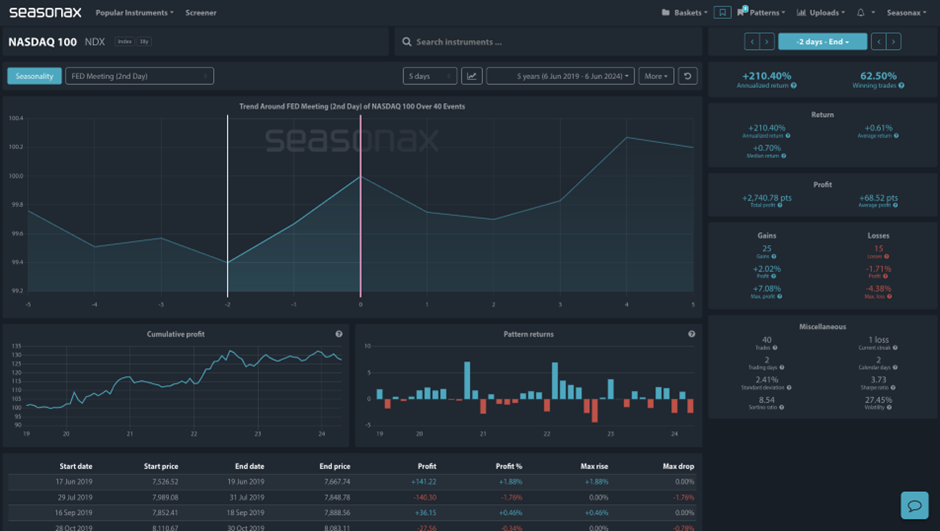

The Nasdaq is know for its sensitivity to Fed interest rates. The growth orientated stocks in the Nasdaq often rely heavily on borrowing to finance their operations and higher interest rates can make their margins tighter. So, when the market is very sensitive to coming rate changes often the Nasdaq can react strongly to those expectations. So, the seasonal pattern in the Nasdaq is particularly interesting. Over the last 5 years the Nasdaq has gained 62.50% of the time and seen a median return of 0.70%. Will the recent inflation data be enough of an encouragement for the Fed to keep signaling coming interest rate cuts for the US? Will these hopes keep the Nasdaq supported into this Wednesday’s Fed meeting?

The Nasdaq made record highs last week, so can those gains continue this week? Will the Nasdaq find dip buyers ahead of the Wednesday Fed meeting?

Sign up here for thousands of more seasonal insights just waiting to be revealed!

The major trade risk here is to be aware that previous seasonal patterns do not necessarily repeat themselves each and every year

Remember, don’t just trade it Seasonax It!