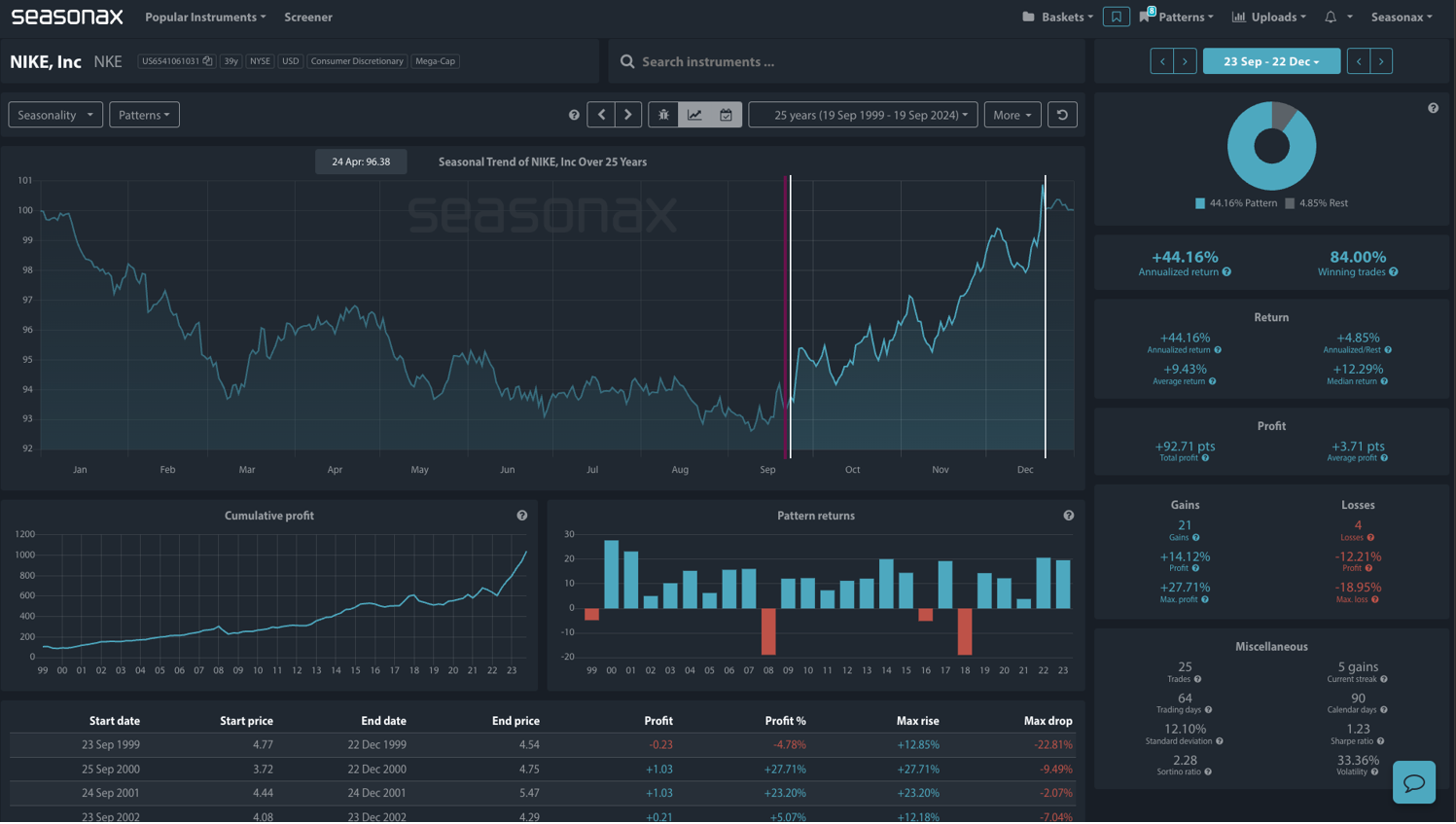

Nike’s stock has been under immense pressure in 2024, down 25% year-to-date due to falling sales and customer defections. However, the recent announcement of Elliott Hill, a longtime Nike executive, returning as CEO has sparked hope among investors. The stock jumped 7.3% in anticipation of a strategic reset aimed at revitalizing the brand. Alongside this leadership change, seasonal data for Nike points to a historically strong period between September 23 and December 22, where Nike has posted an impressive +44.16% annualized return, with a winning trade percentage of 84% over the past 25 years.

Technical look

From a technical perspective, Nike’s stock has shown some recovery, bouncing off recent lows and now trading around $86.12. More encouragingly, the positive ADX line has crossed above 20, indicating the emergence of a potential bullish trend. The ADX (Average Directional Index) suggests that momentum is building, which aligns with the seasonal strength expected in the upcoming months.Will this bounce, combined with positive seasonal data, suggests that the stock could be set for a strong recovery, especially with renewed optimism following the leadership change?

Sign up here for thousands of more seasonal insights just waiting to be revealed!

Trade risks

- As with all seasonality-based analysis, past patterns may not always repeat. Nike is still dealing with the aftermath of declining sales and weaker consumer demand, particularly for lifestyle sneakers. Investors will be watching closely to see if the new leadership can deliver on growth expectations and accelerate product development. n.

Remember, don’t just trade it Seasonax It!