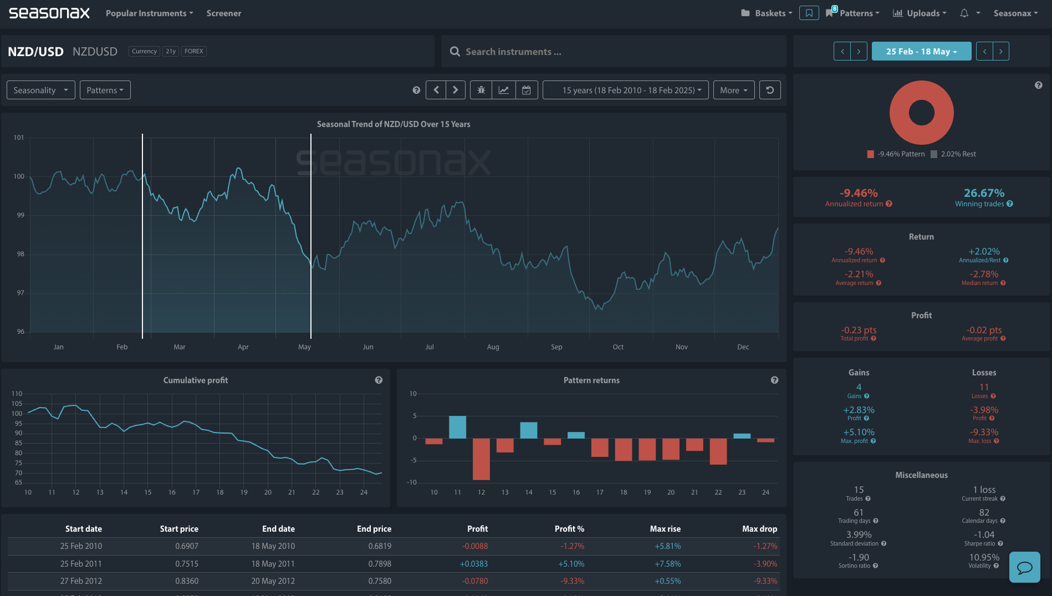

- Instrument: NZDUSD

- Average Pattern Move: -2.21%

- Timeframe: February 25- May 18

- Winning Percentage: 26.67%

You may not realize that the New Zealand dollar (NZD) has a strong seasonal pattern of weakness from late February through mid-May, a trend that aligns with both central bank policy shifts and global trade developments. Given the Reserve Bank of New Zealand’s (RBNZ) latest rate cut, along with the potential for USD strength on escalating trade tensions, we want to analyze the data in more detail.

RBNZ Signals More Rate Cuts – NZD at Risk?

The RBNZ delivered its third consecutive 50bps rate cut, marking its fourth straight reduction in a widely expected move. The central bank noted that inflation is easing, and if economic conditions continue to evolve, further rate cuts may be possible in 2025. Additionally, RBNZ lowered its June 2025 rate forecast to 3.45% (from 3.83%) and its March 2026 forecast to 3.10% (from 3.43%), indicating a dovish outlook.

With rates on a downward trajectory, the NZD faces fundamental headwinds. Lower interest rates reduce the yield appeal of the New Zealand dollar, making it less attractive to global investors seeking higher returns. This aligns with the historical seasonal weakness of the NZD/USD, which has posted an annualized return of -9.46% during this period, with only 26.67% of trades yielding positive returns.

Seasonal Weakness in NZD/USD – A Persistent Trend

The chart below shows the typical development of NZD/USD from late February to mid-May over the past 15 years. The pattern highlights consistent downside pressure, with cumulative losses over this timeframe.

Key seasonal stats:

- Annualized return: -9.46%

- Winning trades: 26.67%

- Average return per trade: -2.21%

This suggests that, barring a shift in economic or monetary policy, NZD/USD may continue to weaken in line with its historical trend.

USD Strength – Trade Tariff Risks Add to the Momentum

On the other side of the trade, the US dollar (USD) may see strength due to rising protectionist policies as the US is considering new reciprocal tariffs, which could bolster the USD on inflationary concerns. This comes amid concerns over global trade friction, with potential retaliation from other economies further fuelling risk aversion.

A stronger USD, combined with NZD’s dovish monetary backdrop, could exacerbate downside risks for NZD/USD. Historical data shows that when these conditions align, the NZD tends to underperform against the USD.

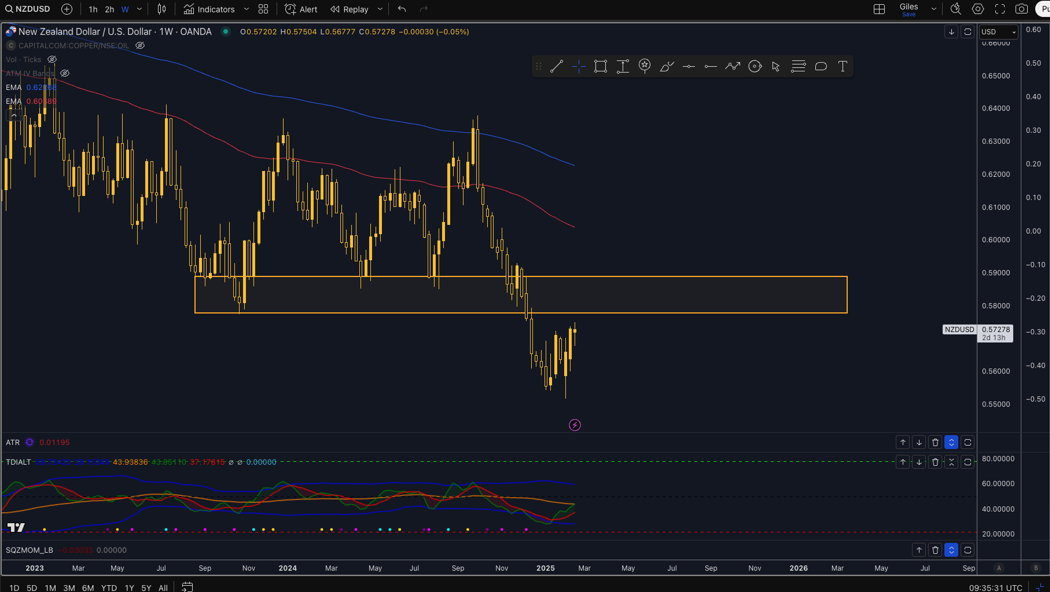

Technical Perspective

From a technical standpoint there is a major weekly resistance area marked on the chart below at 0.5800. This could provide a strong area to look for potential reversals lower in the NZDUSD with the option of a tight stop placement just above this region.

Sign up here for thousands more seasonal insights waiting to be revealed!

Use Seasonax for your professional handling of market-moving events!

Don’t Just Trade It – Seasonax It!

Trade risks

Geopolitical tensions, tariff announcements, and RBNZ policy changes could impact this outlook