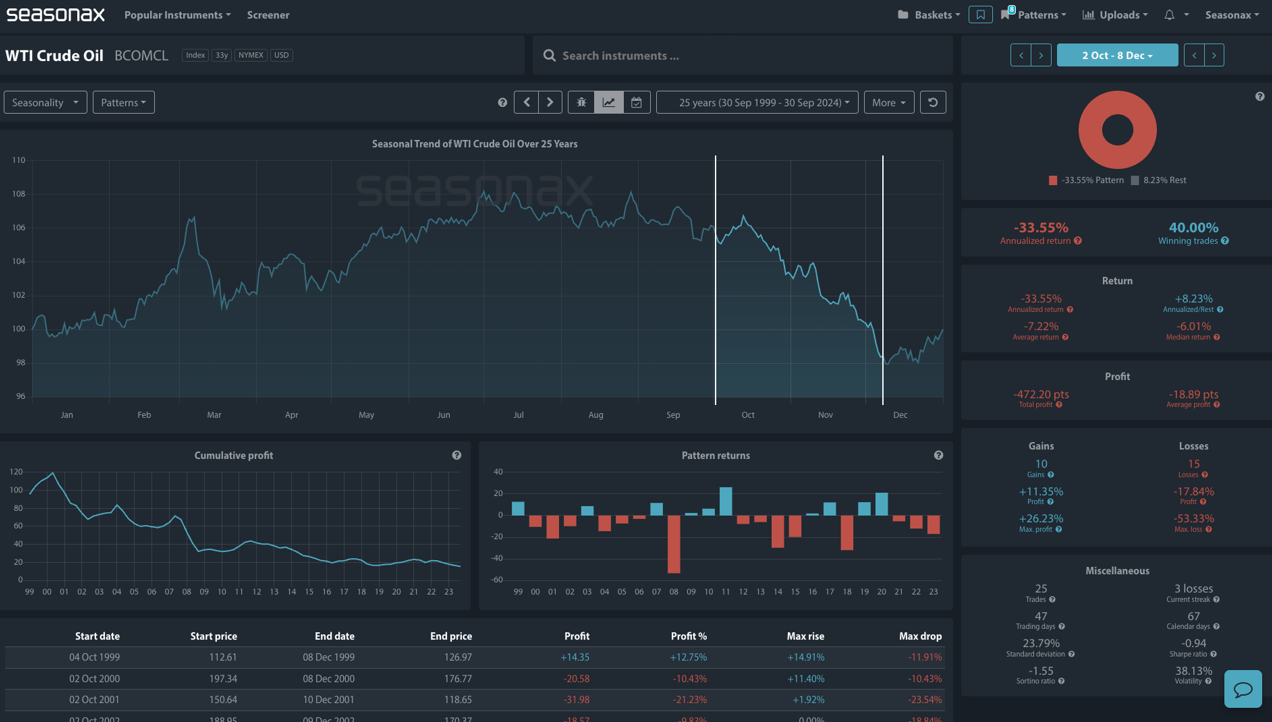

WTI Crude Oil entered the fourth quarter on a bearish note, sliding lower despite geopolitical tensions in the Middle East. This comes amidst broader market concerns, as OPEC+ is expected to increase output while China’s economic slowdown looms. Adding to this backdrop, seasonal patterns for crude oil suggest further downside pressure. Historical data indicates that from October 2 to December 8, WTI Crude Oil has faced a consistent downward trend over the past 25 years, with an annualized return of -33.55% and only a 40% winning trade percentage. This pattern suggests that oil prices often encounter headwinds during this period, aligning with the current market sentiment.

Libya is preparing to bring oil production back online, which could add supply to an already well-supplied market. This increase in output comes at a time when global oil inventories are not particularly tight is likely to exert further downward pressure on prices. OPEC+ is set to hold an online meeting on Wednesday Oct 02 to monitor the market, with plans to restore supply in December. This aligns with the seasonal weakness seen in the chart, as increasing supply often leads to a decline in prices.

Given the weak seasonal pattern from early October through December, combined with expectations of increasing supply from Libya and OPEC+, WTI Crude Oil appears to be under downward pressure. The seasonal data chart the view that oil markets typically struggle during this period, making it crucial for traders to monitor upcoming developments.

Technically, $77 would be an attractive area for shorts with 100, 200. EMA’s, daily resistance, and a key weekly pivot point all converging at that point (marked on the chart below), with stops likely to sit above $85.

Sign up here for thousands of more seasonal insights just waiting to be revealed!

Trade risks

Tensions in the Middle East, including Israel’s ground raids in Lebanon, have so far not provided enough support to offset the bearish fundamentals. According to Saxo Bank’s head of commodities strategy, Ole Hansen, the market is more focused on tangible factors like Libya’s production increases rather than geopolitical uncertainty. If OPEC+ decides to alter its production plans in response to market conditions, it could shift the current bearish outlook. However, as of now, there are no new proposals on the table.

Remember, Don’t just trade it – Seasonax it!