- Instrument: PepsiCo, Inc. (PEP)

- Average Pattern Move: +2.45%

- Timeframe: April 9 – May 16

- Winning Percentage: 80.00%

Dear Investor,

You may not realize that PepsiCo shares have a strong seasonal tendency to climb between early April and mid-May. With consumer staples showing resilience in the face of market volatility, PepsiCo’s historical outperformance in this window could offer a compelling setup. We want to analyze the data in more detail.

The chart shows you the typical development of PepsiCo’s share price between April 9 and May 16 over the last 20 years. During this period, PEP has posted gains 80% of the time, with an average return of +2.45% and a median return of +2.61%. The annualized return for this pattern is an impressive +27.13%.

The cumulative profit chart shows consistent upward moves over the years. This trend likely reflects seasonal demand and earnings optimism heading into Q2 results, along with institutional flows rebalancing into defensive growth names like PepsiCo.

Why PepsiCo?

PepsiCo benefits from:

- Strong pricing power and brand equity

- Resilient revenue across economic cycles

- Increased investor appetite for defensive growth amid macro uncertainty

These factors often draw flows into the stock during earnings season and into the early part of Q2. If the US backtrack on tariffs could Pepsi also benefit from a further lift in sentiment?

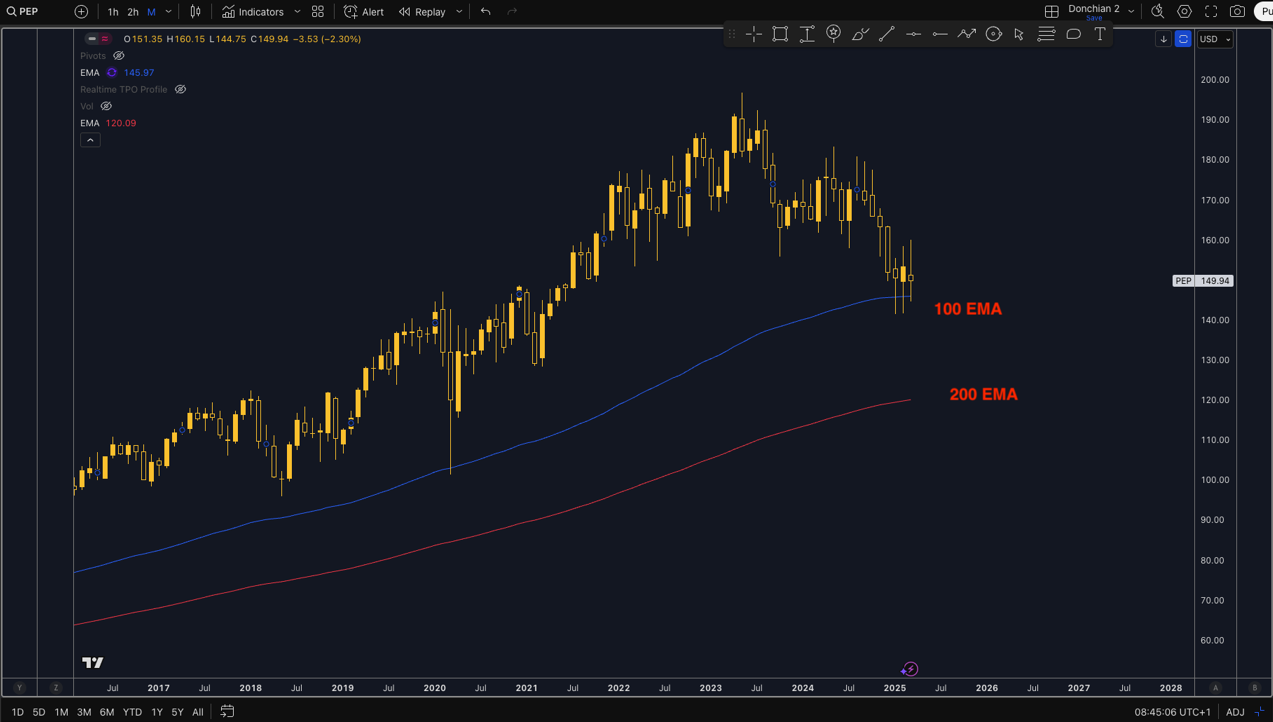

Technical Perspective

From a technical standpoint Pepsi is in a clear uptrend holding above both it’s 100 and 200 EMA marked on the chart below with clear rejection off the 100 EMA on the monthly chart in January and February 2025.

Use Seasonax for your professional handling of market-moving events!

Sign up here for thousands more seasonal insights waiting to be revealed!

Trade Risks:

The moves in PepsiCo may depend heavily on the broader risk tone and incoming economic data. A hawkish Fed pivot or earnings disappointment could limit upside, and defensive staples could underperform if risk appetite returns in force. As always, past seasonal patterns do not guarantee future performance.

Don’t Just Trade It – Seasonax It!