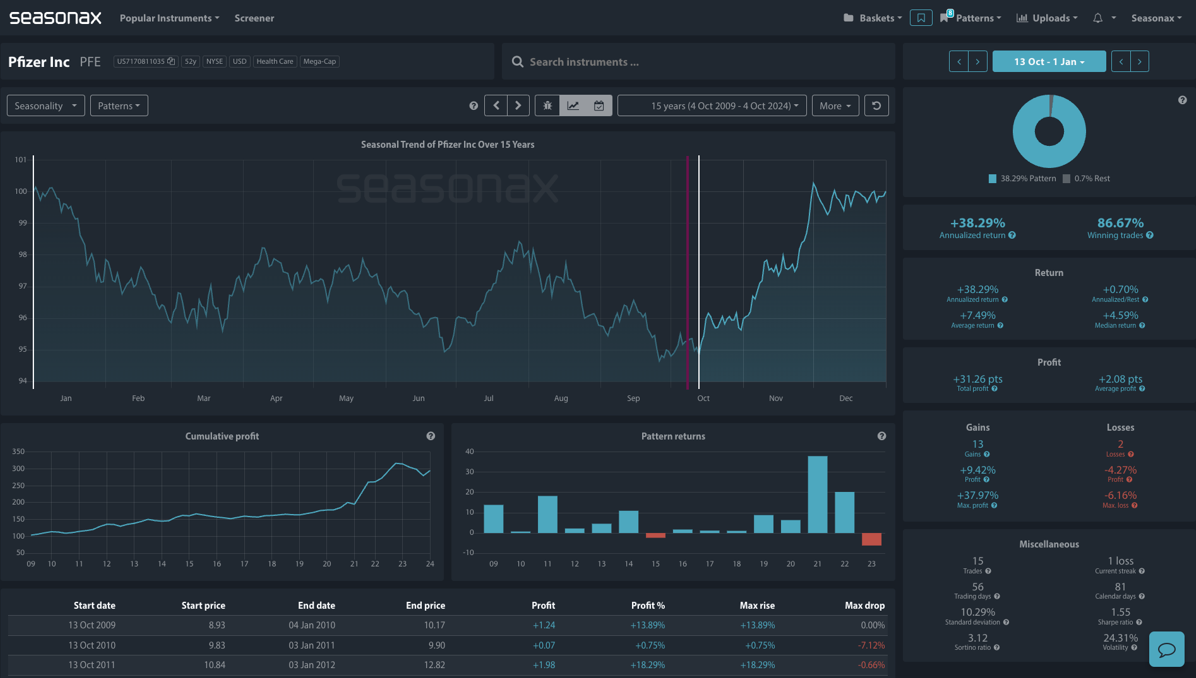

Activist investor Starboard Value has taken a $1 billion stake in Pfizer, seeking to turn around the company’s fortunes. They’ve approached former Pfizer executives to aid their efforts, hinting at potential strategic changes. Pfizer has been facing post-pandemic struggles, primarily due to declining demand for its COVID-19 products, causing its stock price to fall over 50% from its 2021 highs. Pfizer has a historical tendency for gains from October 13 to January 1, with an annualized return of +38.29% over the last 15 years. During this period, the stock has shown an 86.67% win rate with an average return of +7.49%.

This pattern suggests a strong positive bias for investors eyeing the stock in the near term.

Starboard’s involvement signals frustration over Pfizer’s recent setbacks, including costly acquisitions that haven’t delivered expected returns. However, the company’s seasonal strength combined with Starboard’s active engagement could provide an opportunity for a turnaround, although risks remain if new growth drivers are not identified soon.

Sign up here for thousands of more seasonal insights just waiting to be revealed!

Trade risks

Investors may want to monitor developments closely as the company navigates this period of strategic change, particularly any drug treatment breakthroughs.

Don’t just trade it—Seasonax it!