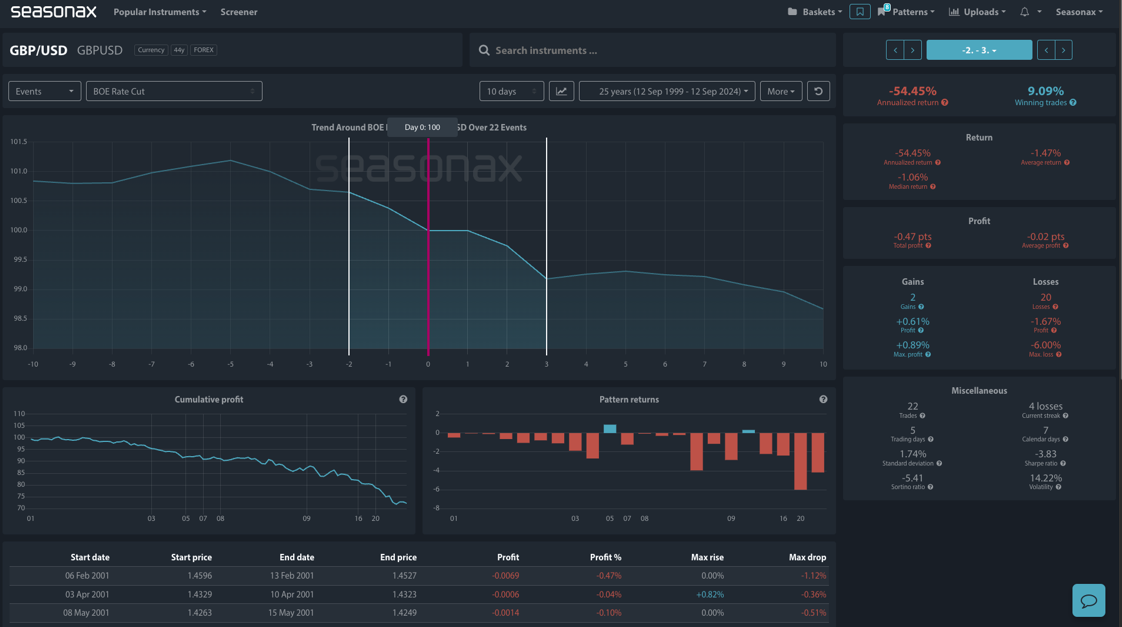

The British pound is under pressure as traders brace for potential rate cuts from the Bank of England (BoE). Historically, rate cuts have led to a significant decline in GBP/USD. The seasonal data supports this trend, showing an annualized return of -54.45% during the 10 days surrounding a BoE rate cut event. GBP/USD has only managed to post a winning trade 9.09% of the time during these periods, further reinforcing the bearish bias.

The selling pressure tends to begin a few days before the official announcement of the rate cut, with losses typically continuing for days after. On average, GBP/USD sees a loss of -1.06% in the run-up and immediate aftermath of the event. Traders should be aware that the pound becomes increasingly less attractive when the BoE cuts rates, as lower interest rates diminish the currency’s appeal to global investors.

UK bonds, or gilts, often see increased demand during these times, as lower rates spur expectations for further cuts. However, this does not translate to pound strength; instead, it signals a more dovish monetary stance, putting further pressure on the currency.

For traders, the clear takeaway is that the pound faces considerable downside risk during BoE rate cuts. Opportunities to short GBP/USD, particularly against stronger currencies like the euro, yen, and dollar, could prove lucrative. With historical data heavily favoring the downside, the key question is: **Will the pound find any relief, or will the BoE surprise with a rate cut?

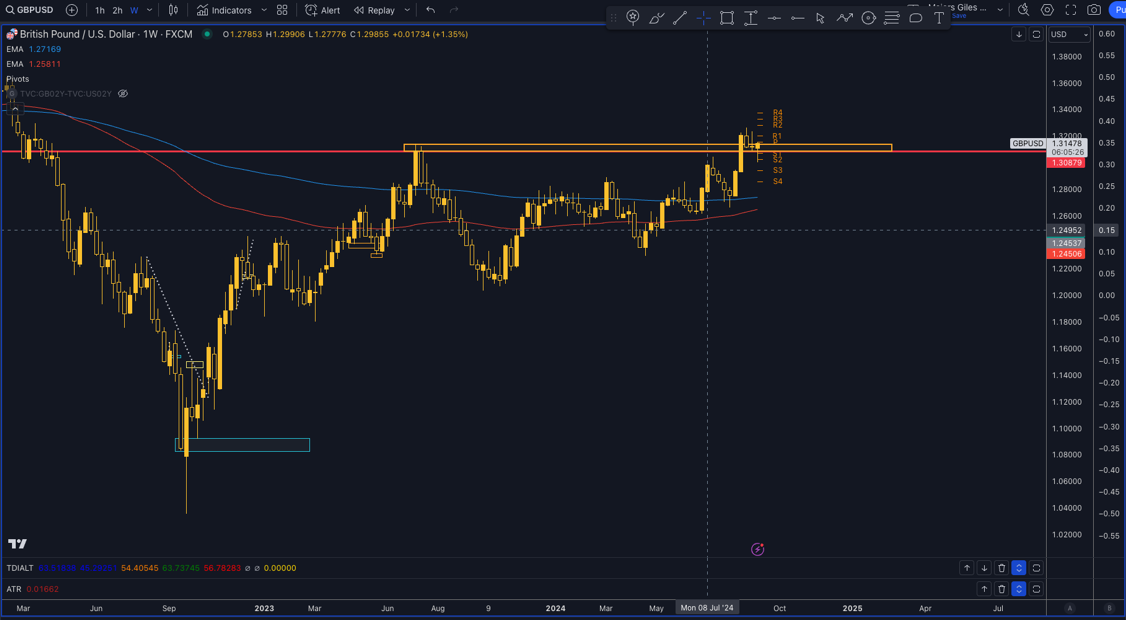

Technically the GBP has been rising on hopes of a series of Fed rate cuts with major daily and weekly support marked around the 1.3100 region. If the BoE surprise with a cut then watch that area to manage risk.

Sign up here for thousands of more seasonal insights just waiting to be revealed!

Trade risks

The major risk here is that previous seasonal patterns do not necessarily repeat each year. External factors such as geopolitical events or unexpected economic data could impact the outcome.

Remember, don’t just trade it Seasonax It!