Dear Investor,

In today’s world COVID-19 is not the only pandemic we are fighting, there is another one that is currently off everybody’s radar – namely obesity!

Every year, obesity generates wagonloads of money for a number of companies. The entire industry is specialized and well-armed with products and services purporting to “solve the problem”.

There is even an index that tracks the performance of companies positioned to profit from providing services to obese people. The constituents of the index range from companies specialized in weight-loss programs, plus-sized clothing, dietary supplements, pharmaceuticals, and so on.

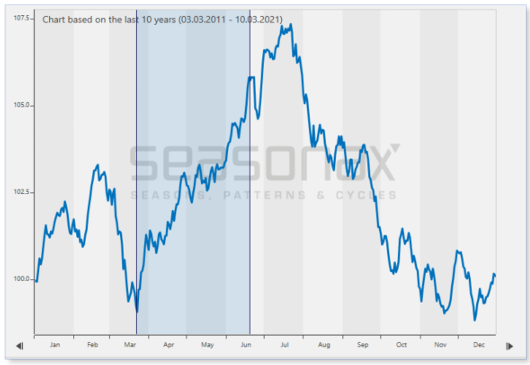

Seasonal Chart of the Solactive Obesity Index over the past 10 years

Source: Seasonax

Keep in mind that unlike a standard price chart that simply shows stock prices over a specific time period, a seasonal chart depicts the average price pattern of a stock in the course of a calendar year, calculated over several years. The horizontal axis depicts the time of the year, while the vertical axis shows the level of the seasonal pattern (indexed to 100).

The index posts gains from March until June, displaying a noticeable seasonal trend over the past 10 years. But are there also “visible” seasonal patterns of individual “obesity stocks”?

Weight loss companies on the seasonal radar

Single stock seasonality is not just a random event that enters the scene out of the blue. Individual stocks exhibit distinct seasonal patterns, either due to internal business reasons, or on account of various external drivers.

These external seasonal drivers include inter alia the weather as well as sentiment at certain times of the year. Below we present two obesity stocks whose seasonal patterns are potentially benefiting from both of these drivers.

The best way to prepare oneself for warmer weather is through a healthy diet and exercise. And who is a better expert on these matters than Medifast Inc (NYSE: MED). Medifast is an American nutrition and weight loss company based in Baltimore, Maryland. Medifast produces, distributes, and sells weight loss and health-related products through websites, multi-level marketing, telemarketing, and franchised weight loss clinics.

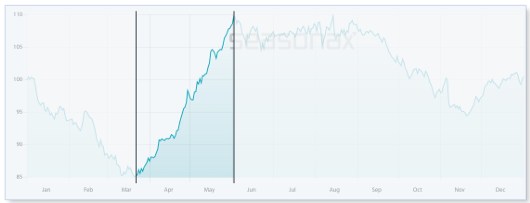

Seasonal Chart of Medifast Inc over the past 15 years

Source: Seasonax – by clicking on the chart image you can highlight the above mentioned time period on the chart and take a closer look at a detailed statistical analysis of the pattern

I have highlighted the strong seasonal phase from March 22 to June 02 calculated over the past 15 years. In this time span of 50 trading days, the shares of Medifast Inc rose on average by a remarkable 36.64 percent.

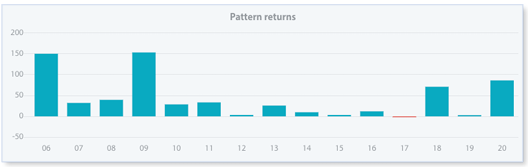

Furthermore, the frequency of positive returns generated over time during this phase indicates that this seasonal pattern is consistent and highly reliable. The bar chart below depicts the return delivered by Medifast Inc in the highlighted time period from March 22 to June 2 in every single year since 2006.

Pattern return for every year since 2006

Source: Seasonax

These companies are not just targeting weight loss anymore – they are marketing an entire new range of products related to health, mind and body that go hand in hand with our new lifestyle and habits.

No pain, no gain

It is a widely known fact that the highest percentage of overweight adults in the world lives in the United States. 47% of the population is expected to be obese by 2030.

The massive weight gain has pushed up demand for drugs and treatments of diseases such as diabetes, heart disease, high blood pressure and even osteoarthritis.

Pharmaceutical giants are boosting their sales numbers with obesity related products.

For pharmaceuticals one rule definitely applies: no pain, no gain.

One of the market players is Danish pharmaceutical group Novo Nordisk, which manufactures and markets pharmaceutical products with a strong focus on diabetes.

The stock of Novo Nordisk enters a strong seasonal period from the end of March until May. Let us take a closer look at the statistics.

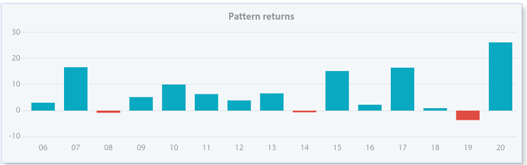

Seasonal Chart of Novo Nordisk over the past 15 years

Source: Seasonax – please click on the interactive chart to conduct further analysis

Over the past 15 years Novo Nordisk has entered into a strong seasonal period from March 22 to May 2. In this time span of 29 trading days, the shares of Novo Nordisk rose on average by 6.91 percent. Moreover, the pattern returns since 2006 have been quite consistent.

Pattern return for every year since 2006

Source: Seasonax – please click on the interactive chart to conduct further analysis

The pharmaceutical industry has gone through a renaissance by specializing in various drugs against obesity. The top three companies ranked by market capitalization have more than 300 billion dollars in annual sales. Quite a number!

Do they really want people to lose weight? We may have some material for an interesting debate here, on how to best keep people out of harm’s way and the merits or drawbacks of capitalism, but this discussion I will leave to someone else.

Timing the market has never been easier

Apart from the stocks I have presented in this issue of Seasonal Insights, there are numerous other stocks that display recurring seasonal patterns.

To make finding these opportunities even easier, we have launched a Seasonality Screener. The screener is an analytical tool designed to identify trading opportunities with above-average profit potential starting from a specific date. The algorithms behind the screener are based on predictable seasonal patterns that recur almost every calendar year.

Feel free to analyze more than 20.000+ instruments including stocks, (crypto)currencies, commodities, indexes by signing up for a free trial.

Yours sincerely,

Tea Muratovic

Co-Founder and Managing Partner of Seasonax