Dear Investor,

Are you ready for an exciting summer? UEFA Euro 2024 is kicking off in Germany from June 14 to July 14!

This highly anticipated tournament, set to unfold across ten dynamic cities, promises to be the biggest sporting spectacle in Germany since the 2006 FIFA World Cup. While fans are gearing up to support their favorite teams, are you ready to pick your winning stocks?

The Football Industry: A Financial Powerhouse

The UEFA Euro Championship has a celebrated history dating back to 1960, and is considered one of the most prestigious sports events worldwide.

It is no secret that the football industry is a money-making machine due to all the business ventures it runs on the side. Apart from selling match tickets, teams make money in areas ranging from broadcasting and sponsorship rights, retail, merchandising, apparel, and product licensing.

However, big sporting events not only drive fan excitement, they also stir investor appetites.

Just like analyzing football teams, let’s dive into potential stock winners among the favored countries’ indices: CAC, FTSE, and DAX.

France: A Strong Contender On and Off the Pitch

Despite a surprising friendly loss to Germany, France remains Europe’s top-ranked team. Olivier Giroud continues to impress, while Marcus Thuram and Randal Kolo Muani offer strong alternatives. Recent performances, including wins over the Netherlands, highlight their strength heading into Euro 2024.

France’s success on the pitch is likely to boost brands like Nike, who sponsor the team. Expect a surge in merchandise sales, higher viewership ratings, and increased ad revenues, positively impacting the stock prices of these companies.

But which company has consistently scored highest on the seasonal radar?

Spotlight on Dassault Systèmes SE

Dassault Systèmes SE, a leading French multinational software corporation, is revolutionizing 3D technology. But can it also revolutionize our investments this summer?

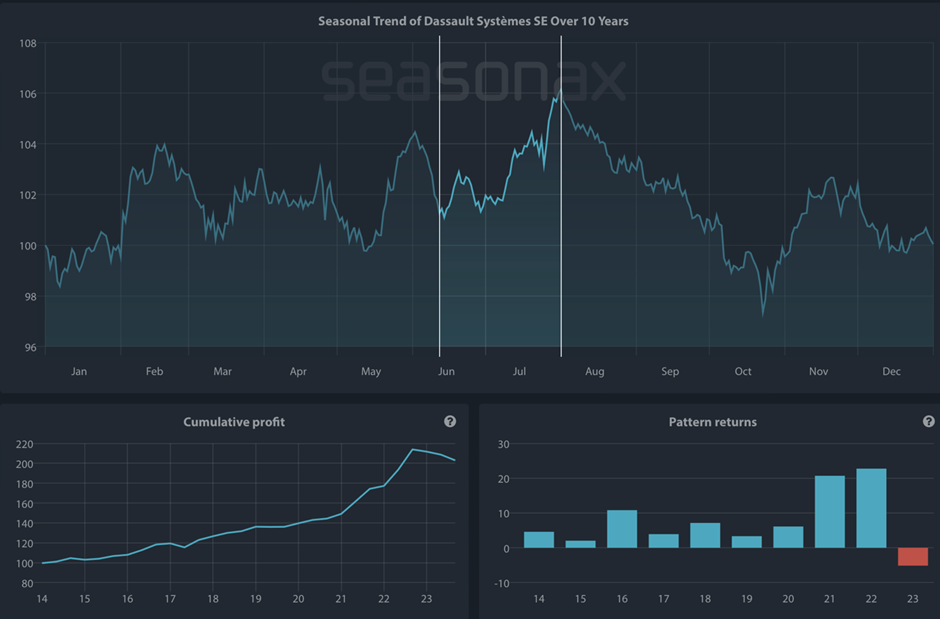

Looking at the seasonal chart below, there has been a clear upward trend that started on June 12 and lasted until August 1. During this highlighted time period, over the last 10 years, Dassault Systèmes made an average return of over 7.33% in only 36 trading days. This has reoccurred 9 out of 10 times since 2014 (see the pattern returns below).

Seasonal Chart of Dassault Systèmes SE over the past 10 years

Source: Seasonax, sign up here https://app.seasonax.com/signup to access further analysis, 30 days for free

How to read seasonal charts? *Unlike regular charts, a seasonal chart doesn’t display price over a set time but shows the average trend over several years. The horizontal axis represents the time of the year, and the vertical axis shows the % change in price (indexed to 100). The prices reflect end of day prices and do not include daily price fluctuations.

England: A Team to Watch

Under Gareth Southgate, England has both talent and experience, having reached the Euro final last time. They secured qualification with two games to spare, showcasing impressive performances, including a comeback win over Italy. Despite some concerns over Southgate’s tactics and recent shaky performances, the team’s attacking prowess, led by Jude Bellingham and Harry Kane, positions them as strong contenders.

Star Player: Scottish Mortgage Investment Trust

From the FTSE Index, the Scottish Mortgage Investment Trust presents a strong “player.” Managed by Baillie Gifford & Co Limited, this Edinburgh-based investment company shows promising returns.

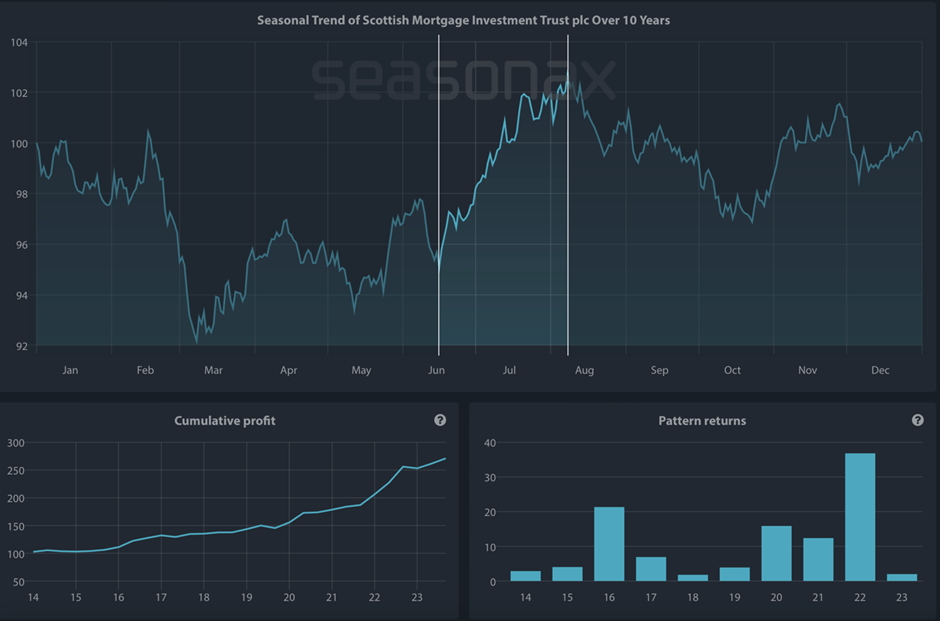

From a market entry perspective, investors who have invested their money from June 16 until August 8, over the past decade, have gained on average 10.32%.

Seasonal Chart of Scottish Mortgage Investment Trust plc over the past 10 years

Source: Seasonax, sign up here https://app.seasonax.com/signup to access further analysis, 30 days for free

Also, broadcasters like the BBC and ITV could see a rise in stock prices due to increased viewer engagement and merchandise sales. Pubs, restaurants, and retail stores in the UK could benefit from heightened consumer spending during the tournament.

Germany: The Host with Potential

Germany’s run-up to Euro 2024 has been rocky, but recent wins over France and the Netherlands show promise. With key players like Rudiger, Kimmich, and the returning Toni Kroos, Germany has a chance to build momentum.

Rising Star: Sartorius AG

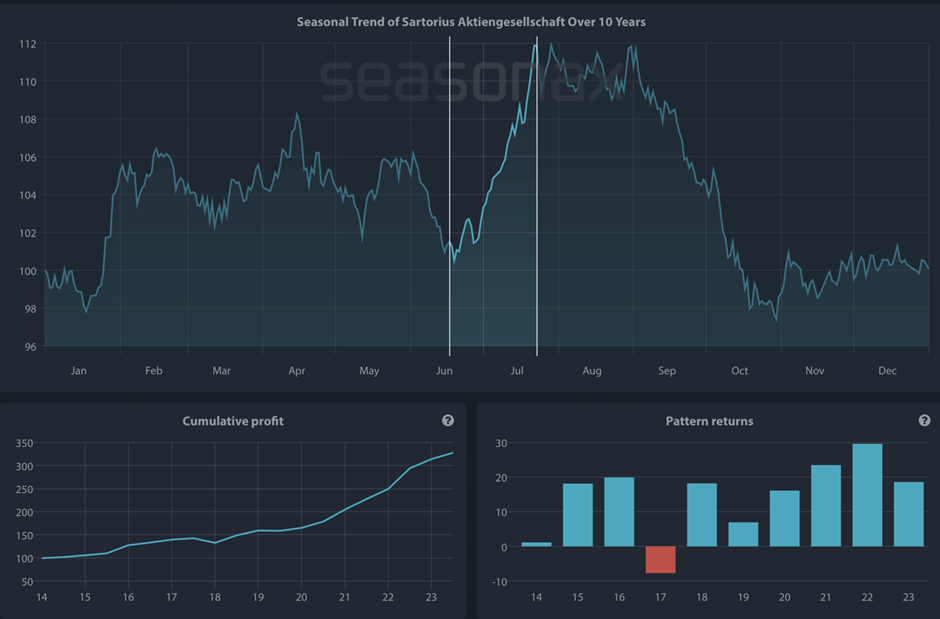

Also, off the field, one company has the potential to gain momentum. Sartorius AG is a pioneering force in the biopharmaceutical industry. During the last 10 years, Sartorius AG delivered strong gains in the time period from June 17 until July 23, on average 13.91%. Will it score once again? We will have to wait and see.

Seasonal Chart of Sartorius AG over the past 10 years

Source: Seasonax, sign up here https://app.seasonax.com/signup to access further analysis, 30 days for free

Underdog Triumphs: Surprise Market Movers

The tournament has had its share of surprises (as the markets do), with underdog teams like Denmark and Switzerland delivering unexpected victories. These thrilling upsets have added an element of unpredictability, driving increased viewer engagement and media revenues, which in turn positively affected the stock prices of broadcasting companies and sponsors.

Will there be other surprise movers? Perhaps the Croatian team, led by captain Luka Modric, in what might be his last Euro tournament?

Make Winning Moves in the Stock Market

Just as you analyze the strengths of football teams, evaluating the performance of stocks with a track record of success can lead to profitable investments.

When choosing the “market movers”, make use of Seasonax to identify best entry and exit points based on recurring patterns.

Test 30 days for free, and explore patterns across various markets, including indices, (crypto)currencies, stocks, and commodities.

Remember, don’t just trade it, Seasonax it!

Yours sincerely,

Tea Muratovic

Co-Founder and Managing Partner of Seasonax