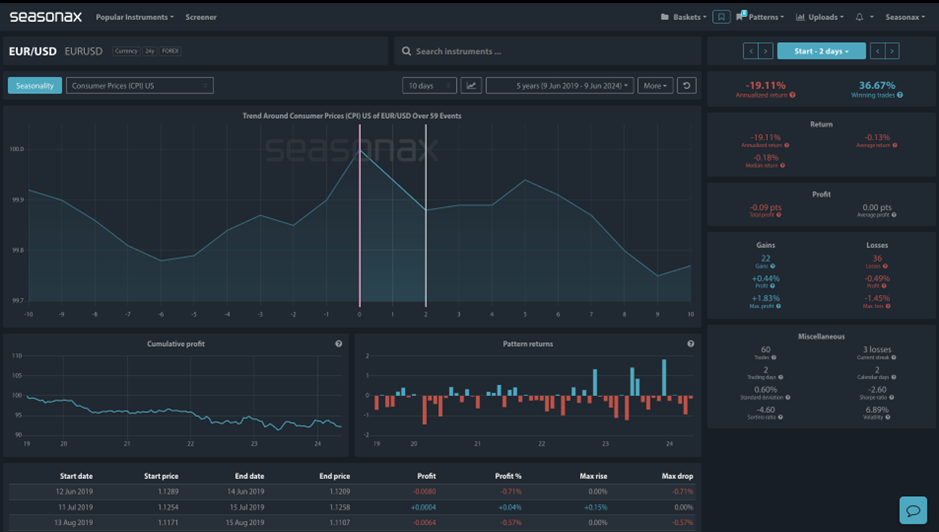

On Wednesday the US CPI data is released. The EURUSD has been weighed down this week on the strong NFP print from Friday, with the headline jobs number coming in above the 12 month average, and the weekend results from the European Parliamentary elections. Furthermore, the seasonals point to more EURUSD selling out of the US CPI print. Over the last 5 years the EURUSD has lost value over 60% of the time with maximum falls of 1.45% in the 2 days after the release.

If the CPI print surprises to the upside, and comes in above market’s maximum expectations, then watch for further USD buying and more EURUSD selling. However, remember that the Fed meeting is also on Wednesday, so that is another key event risk for the EURUSD to be aware of. See the CPI minimum and maximum expectations highlighted below, so you can recognise what a surprise print will look like.

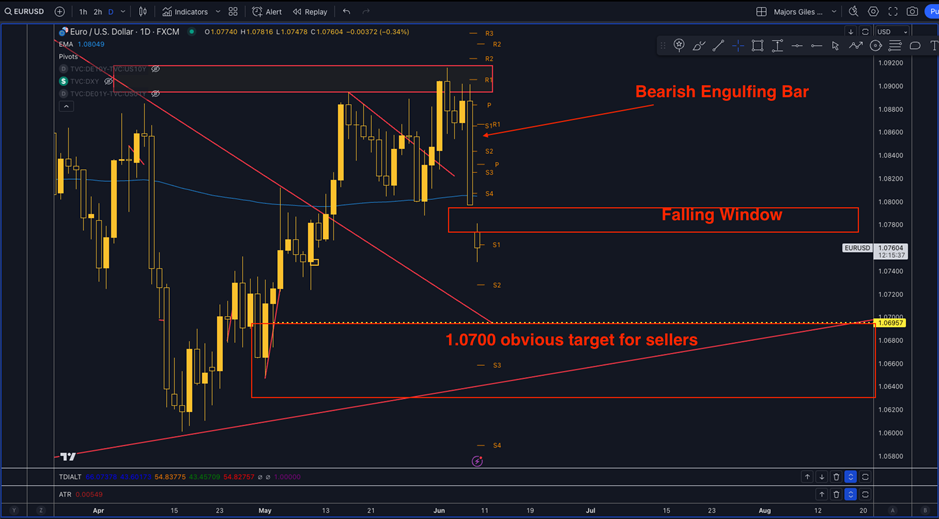

Technically, the EURUSD has fallen lower with 1.0700 an obvious near term target for sellers on the recent EUR weakness and USD strength.

Sign up here for thousands of more seasonal insights just waiting to be revealed!

The major trade risk here is to be aware that the Fed are meeting in a just a few hours after the release of the CPI print.

Remember, don’t just trade it Seasonax It!