On Tuesday we have the hot anticipated US CPI print.

Headline and core inflation is expected to fall from last month’s prior readings and investors are closely watching for this data point to get a sense of the Fed’s next direction.

If the headline comes in above 6.7% and the core above 5.7% then markets will interpret that as meaning the Federal Reserve will need to be more aggressive in hiking rates this year. This will result in some immediate USD strength (EURUSD weakness).

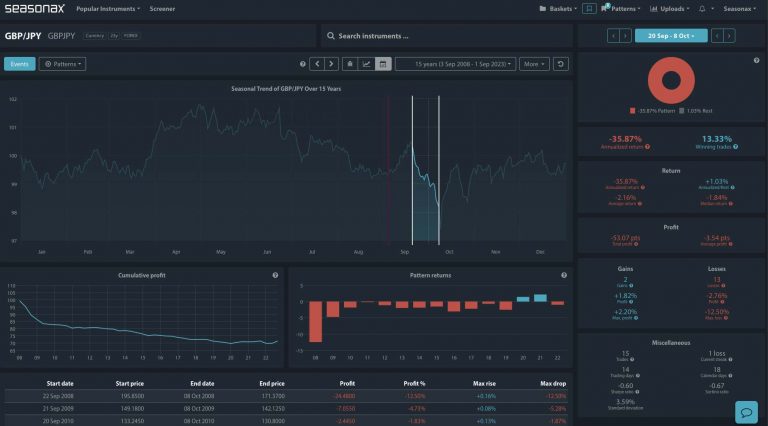

Looking at historical reactions to the US CPI print we can see that the USD has gained after CPI prints on average over 179 CPI r prints in 15 years. So, any strong CPI readings will have seasonal support for USD strength and EURUSD downside on the day of the print.

Major Trade Risks:

The major trade risk here is that some Fed speakers due out later in the day would counter any strong CPI prints, so watch out for Fed speakers.

Remember, don’t just trade it, but Seasonax it!