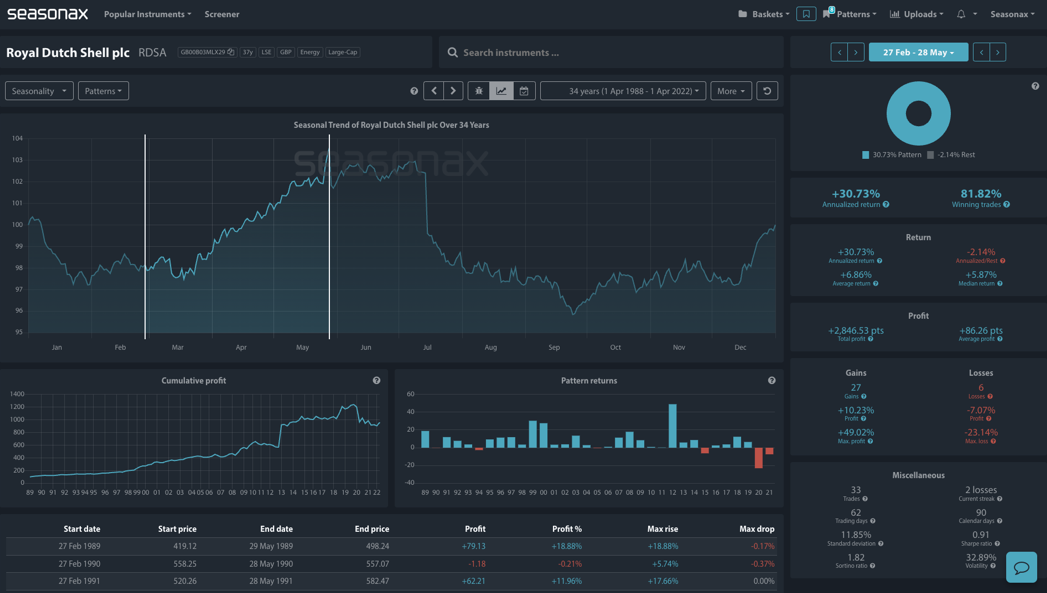

- Instrument: Royal Dutch Shell

- Average Pattern Move: +6.86%

- Timeframe: February 27- May 28

- Winning Percentage: 81.82%

Market Analysis and Drivers

Shell Plc’s latest global energy outlook highlights a surprising factor that could extend oil demand growth well into the 2030s—artificial intelligence. According to the report, the integration of AI across industries will drive significant economic expansion, with automation and manufacturing advancements leading to an increase of 3-5 million barrels per day in oil consumption through the next decade. Additionally, natural gas demand is projected to grow into the 2040s, while petrochemicals could see sustained demand into the next century. Shell’s outlook also anticipates the phasing out of coal in power generation by 2030 and natural gas by 2035, but notes that carbon removal technologies and AI-driven efficiencies will help reduce the global carbon intensity of energy production over time.

With AI set to drive higher long-term energy consumption, does Shell’s historical seasonal trend align with this bullish backdrop?

Seasonal Data Analysis

Shell enters a historically strong seasonal period from February 27 to May 28, where it has delivered an annualized return of +30.73% with a win rate of 81.82% over the past 34 years. The average return sits at +6.86%, with a median return of +5.87%, reinforcing the stock’s tendency to rise in this window. The cumulative profit trend highlights a steady uptrend, suggesting consistent bullish momentum during this period.

Shell’s largest historical gain during this timeframe reached +49.02%, while the biggest recorded loss was -23.14%, showing that although gains dominate, downside risks remain. However, note that this was during covid when oil demand plummeted around the world, so it could be discounted as an outlier. Given the AI-driven demand outlook, Shell’s seasonally strong period could align with growing investor interest in energy names, particularly those positioned to benefit from long-term hydrocarbon resilience and industrial AI adoption. Please note that Shell’s share structure has now been simplified and it is no longer split into the A and B shares.

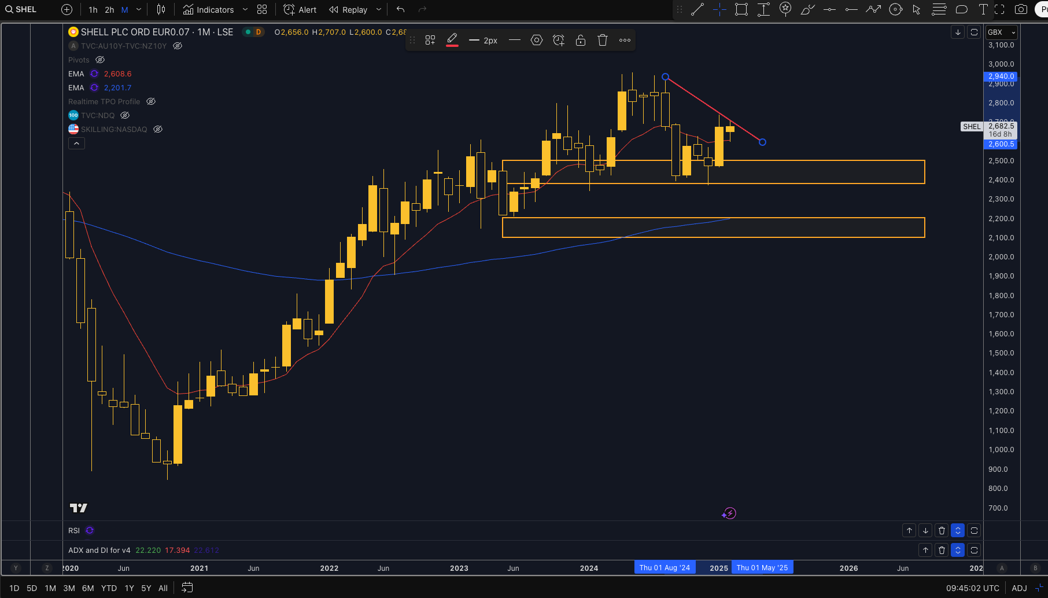

Technical Perspective

From a technical standpoint, Shell has major support at 2,500 and 2,200 on the monthly chart. A clean break above 2,750 opens up the potential for a 2,900 re-test

Sign up here for thousands more seasonal insights waiting to be revealed!

Trade risks

US oil policy and Middle East tensions is a serious source of oil volatility right now and a major risk to the outlook.

Don’t Just Trade It – Seasonax It!