Yesterday we saw a big miss in the US CPI print which allowed the S&P 500 to move significantly higher on ‘peak Fed narrative’ hopes. Seasonax’s event feature allowed us to expect upside in the S&P 500 in the event of a miss and the same feature leads us to expect potential for dip buying in the S&P 500 today.

The key risk to this outlook will be the US retail sales data that’s coming out at 1:30 UK time, however, another miss here in the retail sales print and a miss on the PPI print that comes out at the same time and the S&P 500 should be in line for another leg high. Seasonax’s event feature shows us that on average there’s been 57.50% winning buy trades for the S&P 500 over the last 10 years on the day after the US CPI print. Dip buying ahead?

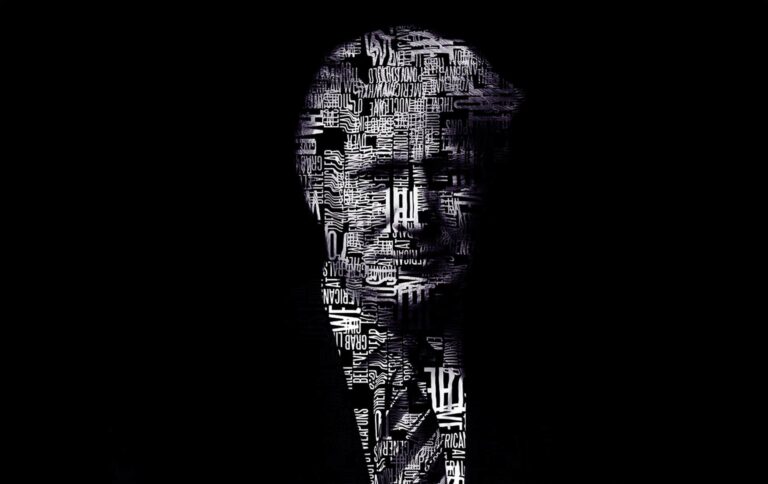

The major trade risk here is if President Biden’s and China’s President Xi meeting is unsuccessful and sours sentiment.

Remember don’t just trade it, Seasonax it!