Dear Investor,

As the calendar turns toward February, the consumer discretionary sector often comes into focus, buoyed by seasonal trends that have delivered consistently strong performances. This year, the prospect of the opportunity is once again compelling, particularly with the President Trump expected to implement pro-growth, business friendly policies. Is this a great time to take advantage of this trend?

On top of a potential lift for US stocks from Trump we should also recognise that the latest December US Core CPI print came in a little softer than expected at 3.2% y/y vs the 3.3% y/y expected. This prompted a strong rally in US stocks as market participants were relieved that inflation was not obviously spiraling out of control, and slightly less than forecast. Ok, so we now have two potential reasons to anticipate further stock gains at the start of Trump’s second Presidency.

Let us now explore how Consumer Discretionary sector’s seasonal tendencies could benefit your portfolio and highlight a selection of stocks with robust historical returns during this period.

The Power of Seasonality: Late January to April

Consumer discretionary stocks have historically shown strong seasonal trends starting in late January. There are a few reasons for this: consumers refresh spending habits after the holidays, retail inventories align with new product launches, and early-year optimism spurs discretionary purchases. Trump’s presidency could directly boost consumer discretionary stocks through pro-business policies like tax cuts and deregulation, which in turn would stimulate consumer spending. A robust labour market, with December’s NFP print surprising to the upside with the US economy adding 256K jobs vs the maximum 200K expected. No signs of cooling in the US labour market there. However, the risk is not all one way as protectionist trade measures (e.g tariffs) might raise costs for retailers reliant on global supply chains. Exactly how heavy President Trump will go on tariffs is still not know at the time of writing.

Four Top Seasonal Performers to Watch

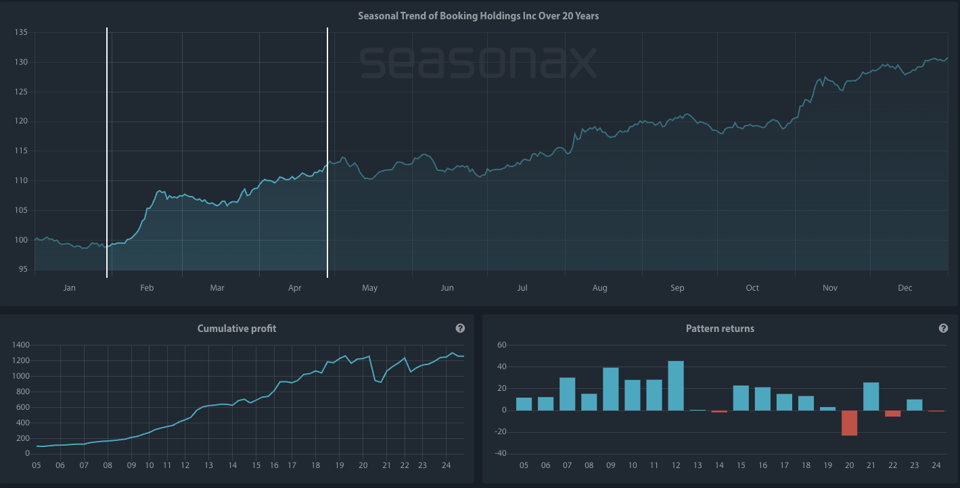

1. Booking Holdings Inc. (BKNG)

Here are four consumer discretionary stocks that have demonstrated impressive seasonal returns. As consumers plan spring and summer vacations, Booking Holdings benefits from increased travel bookings. Historically, its strong performance during this period reflects heightened demand for its services. The chart below shows the seasonal trend based on the last 20 years and a consistent seasonal uptick starting in late January, aligning with a key planning phase for leisure and business travel. With an 80% wining trade percentage and an average return in double digits, it’s one stock to watch closely.

- Annualized Return: +69.15%

- Average Return: +13.48%

- Seasonal Period: January 30 to April 28

- Win percentage: 80%

2. Tractor Supply Company (TSCO)

As spring approaches, demand for gardening, pet supplies, and rural lifestyle products boosts Tractor Supply’s sales, driving its seasonal outperformance. The seasonal chart for the stock below shows a clear upward seasonal trend over the last twenty years during the end of winter months at the start of the year coinciding with the start of the planting season. Again an 80% winning trade percentage and an average return of over 11% make this one stock to look at.

- Annualized Return: +58.99%

- Average Return: +11.38%

- Seasonal Period: January 30 to April 25

- Win percentage: 80%

3. Domino’s Pizza Inc. (DPZ)

A firm takeaway favourite is Domino’s which benefits from steady consumer spending patterns, particularly during colder months when home dining and take aways remains popular. Domino’s seasonal chart shows the seasonal trend for the last twenty years below shows a pronounced rally at the start of the year supported by an impressive 90% success rate and another double digit average return.

- Annualized Return: +54.51%

- Average Return: +10.64%

- Seasonal Period: January 30 to April 25

- Win percentage: 90%

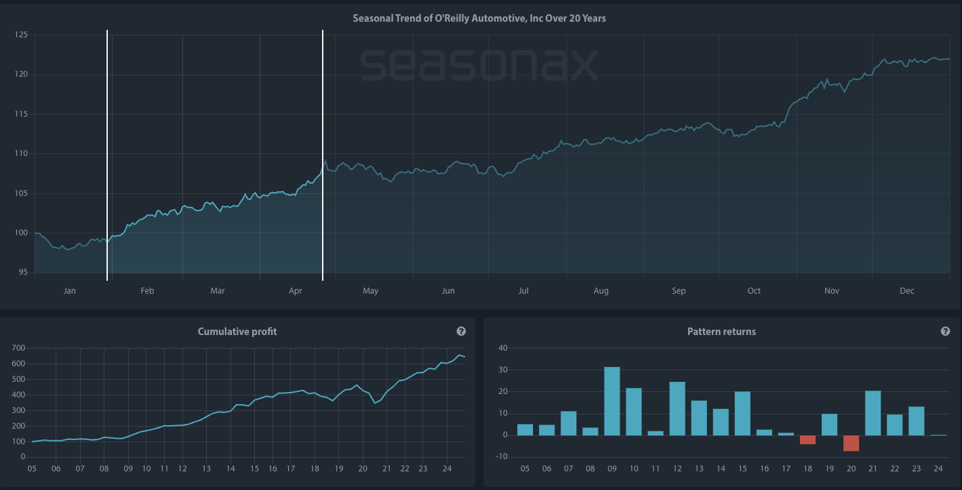

4. O’Reilly Automotive Inc. (ORLY)

Finally, let us turn to the automotive sector which often sees a boost as consumers prepare their vehicles for spring travel after the winter wear and tear on vehicles, creating tailwinds for O’Reilly’s seasonal outperformance. A 90% win percentage, and a steadily rising cumulative profit, over the last two decades highlights the strong historical performance of the stock during this seasonal window. Will the pattern repeat itself this year?

- Annualized Return: +47.21%

- Average Return: +9.52%

- Seasonal Period: January 30 to April 26

- Win percentage: 90%

The Numbers Speak

Across these stocks, the seasonal periods consistently align with favorable market conditions. Win ratios ranging from 80% to 90% underscore the reliability of these patterns, while Sharpe ratios demonstrate a strong risk-adjusted performance.

Why It Matters

Seasonality isn’t merely about repeating trends; it’s about capitalising on statistically significant patterns that align with deep rooted fundamental drivers. By understanding how and why certain stocks outperform during specific periods, you can position your portfolio for potential gains. Will President Trump’s pro-business agenda help drive consumer stocks higher once again this year? Will the normal seasonal forces play out like in previous years? Seasonax can help identify the best opportunities by analysing thousands of instruments across different sectors and regions in the click of a button.

Best regards,

Giles Coghlan, CMT

Macro Strategist Seasonax