Dear Investor,

Keep calm and start playing video games

In recent years the video game industry has grown tremendously – video game companies have embraced innovation and reshaped the whole industry. Experts are forecasting that the sector will generate $196 billion in revenues by 2022.

But what is the situation in light of the latest economic developments and the COVID-19 crisis that has pushed the global economy and many industries over the edge?

In contrast to many other industries, the video game industry proved generally more resilient and many stocks even benefited from the lockdown period and the stay-at-home environment. With many people stuck at home and unable to work all over the world, online gaming has seen record numbers of players join during the pandemic and has actually experienced a boom as a result of the crisis.

In this issue of Seasonal Insights I will analyze two stocks that represent the video game industry and show their seasonal patterns in the course of a calendar year. As many readers probably know, seasonal effects are predictable patterns that recur almost every year. These effects serve to determine whether a short or long position in certain stocks is statistically highly likely to be profitable. They reoccur due to various events that take place during the year (e.g. tax and balance sheet deadlines, earning reports, sport events, investor sentiment…) and determine the price trends of individual stocks.

Video games: in line with the new social distancing trend?

Not only do online video games tick all the boxes regarding the requirements imposed during the pandemic – from social distancing to isolation to quarantine – but they also provide us with that rare feeling of social interaction that many people have craved for months.

One of the companies handling the current situation quite well is Activision Blizzard – an American video game holding company based in sunny California. The company publishes, develops and distributes interactive entertainment software and peripheral products and is one of the biggest producers of video games including some of the most durable franchises (World of Warcraft, Candy Crush, Overwatch). This year the sun has definitely been shining for the company, as it has reaped nice profits during the pandemic.

The stock typically generates gains until end of July, and 2020 was no exception. A detailed analysis and the period of seasonal strength can be seen in our seasonal chart below.

Please note, unlike a standard price chart that simply shows stock prices over a specific time period, a seasonal chart depicts the average price pattern of a stock in the course of a calendar year, calculated over several years. The horizontal axis depicts the time of the year, while the vertical axis shows the level of the seasonal pattern (indexed to 100). With that in mind, let us examine the seasonal chart of Activision Blizzard, which shows the seasonal pattern of the stock over the past 10 years.

Seasonal pattern of Activision Blizzard Inc over the past 10 years

Activision Blizzard Inc typically delivers strong seasonal returns mostly in the first half of the year.

Source: Seasonax (click here to examine the examine the best investment period for the selected stock

I have highlighted the strong seasonal phase from January 2 to July 26. On average Activision Blizzard Inc has delivered strong returns of 24.29% during this period.

Even more important is the pronounced consistency of the positive returns generated during this phase, which suggests that this pattern is highly reliable.

The bar chart below depicts the return delivered by Activision Blizzard Inc in the relevant time period from January 2 to July 26 in every year since 2010. Blue bars indicate years with positive returns.

Pattern return for every year since 2010

As an aside to this, a deeper analysis reveals that the stock also produced positive returns during difficult years such as 2008 and 2009.

However, there is yet another strong seasonal period due in September, or to be more precise from August 25 to September 14.

Don’t forget that by clicking on the interactive link, you can highlight the above mentioned period on the chart and examine the detailed statistical analysis of the August-September pattern.

Is there another Video Game Sector opportunity in September?

Game Stop Corp – an American video game, consumer electronics and gaming merchandise retailer is also worth a look. It is market leader in video game retailing and has a presence in more than a dozen countries worldwide, including 10 European countries, the US, Canada, Australia and New Zealand.

But will there be a seasonal opportunity in coming months?

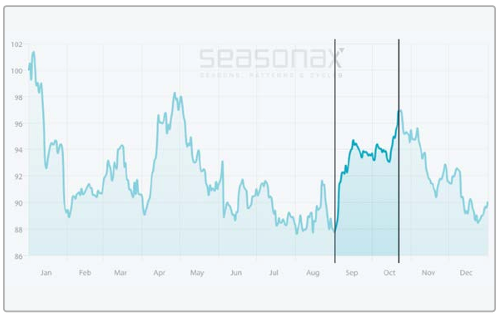

Seasonal pattern of Game Stop Corp over the past 10 years

GameStop Corp typically delivers strong seasonal gains during the months of September and October.

Source: Seasonax (click here to examine the examine the best investment period for the selected stock

I have highlighted the strong seasonal phase from September 1 to October 22. On average Game Stop Corp has delivered strong returns of 10.88% during this period, which corresponds to a very respectable annualized gain of 111.38%.

Furthermore the frequency of positive returns generated during this phase over time indicates that the seasonal pattern is consistent and highly reliable.

The bar chart below depicts the return delivered by Game Stop Corp in the relevant time period from September 1 to October 22 in every year since 2010. Blue bars indicate years with positive returns.

Pattern return for every year since 2010

Game Stop Corp rallied in 8 out of 10 cases

Source: Seasonax (click here to examine the examine the best investment period for the selected stock

Don’t forget by clicking on the interactive link you can do further analysis of the stock and examine additional statistical data.

Negative effects on the video game industry

While benefiting from stronger demand and the stay-at-home culture, the video game industry was also faced with headwinds due to the cancelation of industry events that were supposed to take place during the year. One of them was E3 2020, the largest trade event, the cancelation of which caused future projects to be delayed or suspended. In China the outbreak of Covid-19 has impacted supply chains for electronics, which may limit hardware availability once the pandemic begins to recede. In addition, many e-sports events have been forced to switch to full online formats.

When investing into certain stocks, examine all positive and negative seasonal trends before making a final decision – always let the probabilities work in your favor.

Enter the world of seasonal opportunities

Apart from the video game stocks we have presented in this issue of Seasonal Insights, there are numerous other stocks that display regularly recurring weak and strong seasonal periods.

To make finding these opportunities even easier, we have launched the new Seasonality Screener.

The Seasonality Screener is a tool designed to identify trading opportunities with above-average profit potential based on predictable seasonal patterns that recur almost every calendar year. The Screener is an integral part of your Seasonax subscription and calculates seasonal patterns for profitable trades starting from a specific date. Find the most profitable trades with just 2 mouse clicks TODAY!

Yours sincerely,

Tea Muratovic

Co-Founder and Managing Partner of Seasonax