The Fed meets on May 03 and there is an increasingly bearish attitude to stocks and the prospects of further gains in stocks are viewed nervously.

Despite these bearish projections April has been a strong month for some of the major indices. The S&P500 has been able to make gains of 0.82% and there is still 10 days of the month left.

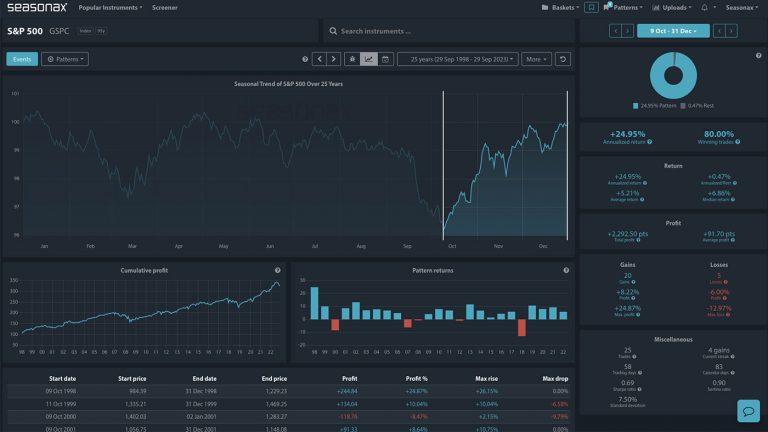

So, with bearish analyst reports, worries over higher rates, a tightening of credit conditions, and geo-political concerns bubbling away what can the seasonals tell us? Quite a lot.

The old saying ‘sell in May and go away’ is marked on the seasonal chart.

May has been a negative month over the last 95 years, so will this time perfectly for the Fed meeting? Will the Fed push back against the market’s hope of rate cuts this year? Will that be the catalyst that sends stocks lower?

Major Trade Risks:

The major risk here is if the rate decision contain a dovish surprises which makes markets once again expect a pause from the Federal Reserve

Remember, don’t just trade it, but Seasonax it!