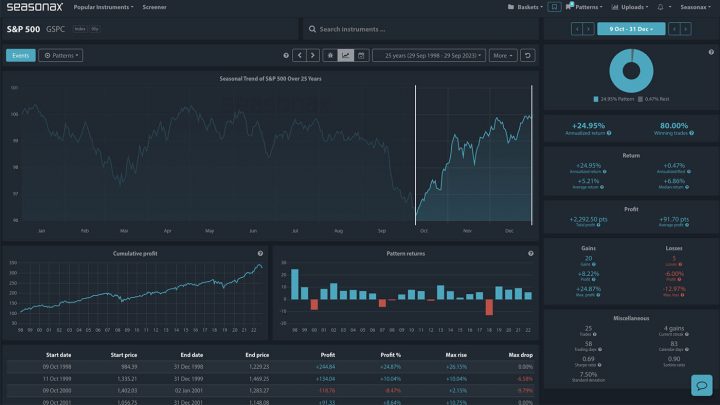

The S&P500 Reaction To Fed Meetings Over The Last 5 Years

With so many uncertainties ahead of the Fed meeting it can be very helpful to see the reaction of the S&P500 over the last 5 years out of Fed meetings! The bias for heavier selling is clearly there, so this can help frame expectations on a surprise hawkish decision.