The Bank of Japan’s Upcoming Policy Meeting: Implications for USD/JPY Instrument: USDJPY

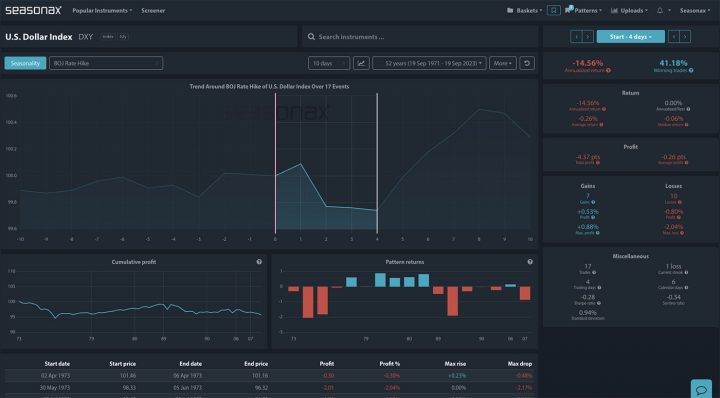

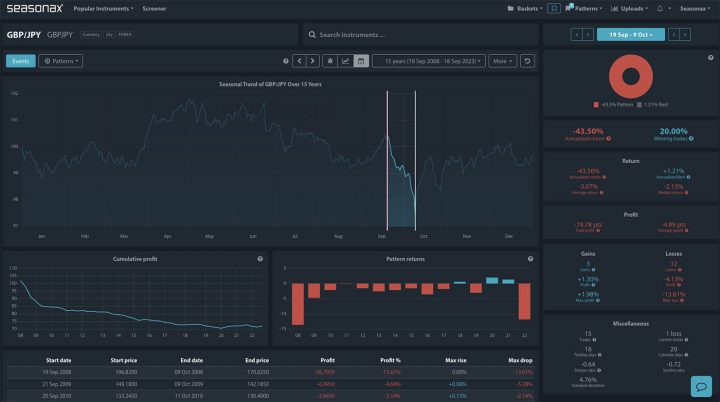

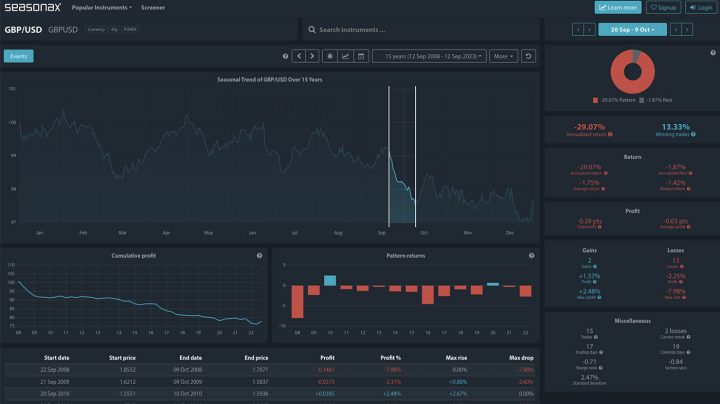

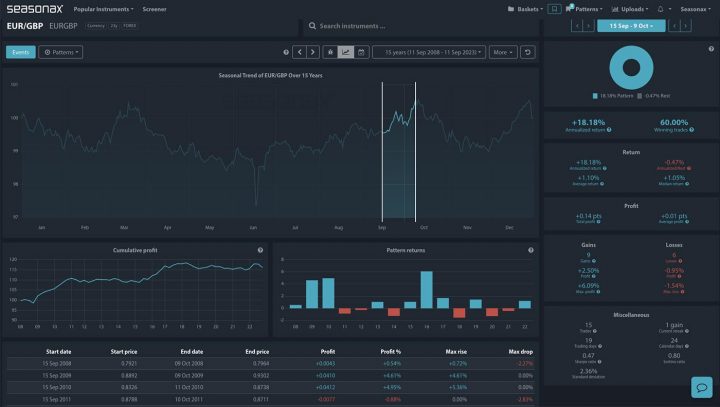

The Bank of Japan's policy meeting on January 23-24, 2025, is set to shape the USD/JPY outlook. With an 80% probability of a rate hike from 0.25% to 0.5%, historical patterns suggest a +0.53% average move in USD/JPY on the day of the decision, with a 75% winning rate.