US CPI Ahead: Will USD/JPY Buck the Seasonal Weakness?

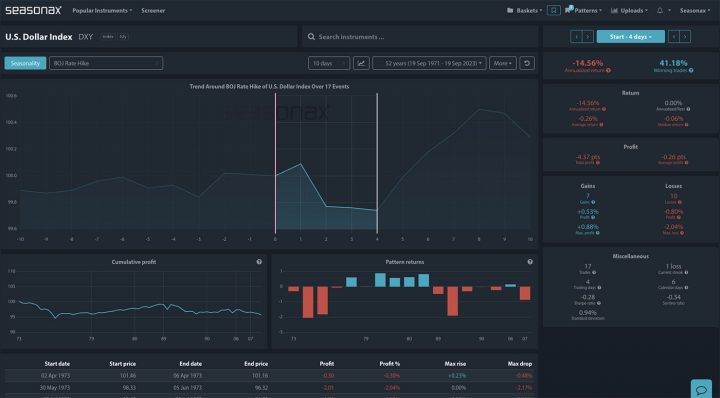

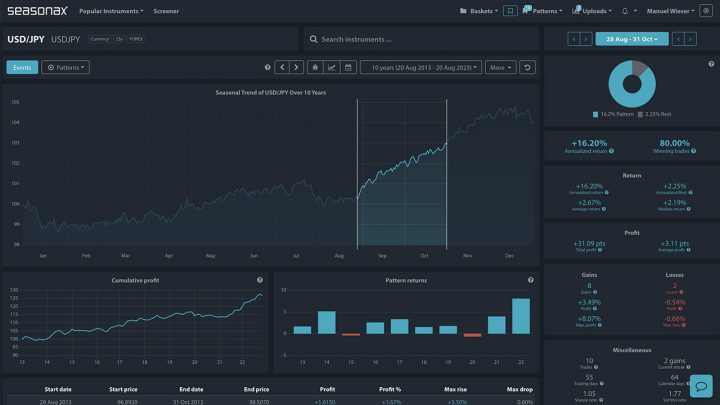

The USD/JPY pair has shown a seasonal tendency to weaken on days when US CPI is released, especially after soft inflation surprises. A historical average return of -0.14% on CPI day reflects the market’s sensitivity to disinflation. With the next release set for April 10, traders are watching closely. A lower-than-expected print could reinforce bets on Fed rate cuts and push the yen higher.