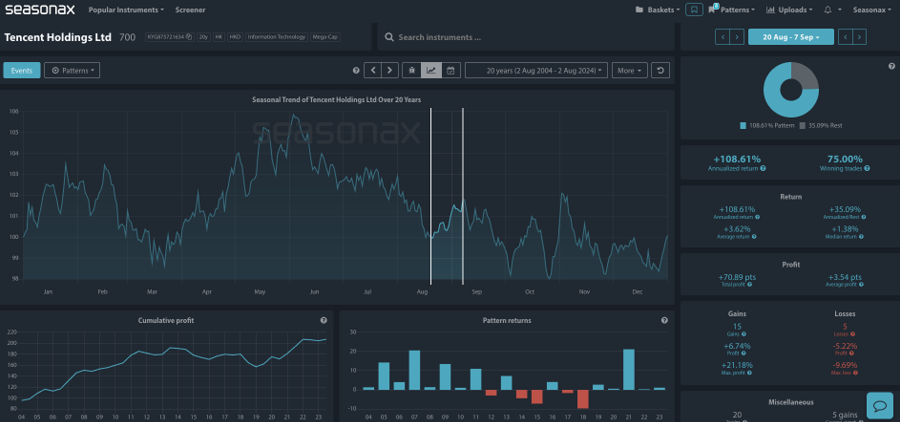

Tencent is riding high following the blockbuster release of Black Myth: Wukong, a game that has taken the global gaming community by storm. As investor enthusiasm grows, Tencent is also entering one of its strongest seasonal periods. Historically, from August 20th to September 7th, Tencent’s stock has delivered a remarkable +108.61% annualized return, with a 75% win rate over the past 20 years.

Tencent’s prospects appear increasingly promising, driven by the recent blockbuster success of Black Myth: Wukong, a Chinese-made game backed by the company that quickly became the fourth most popular title ever on Steam within hours of its release. The action-adventure game, based on the legendary Monkey King, drew over 1.4 million concurrent players globally on its first day, surpassing popular titles like Cyberpunk 2077 and Elden Ring. This remarkable debut signals not only the game’s potential impact but also a broader shift in China’s $40 billion gaming industry, which is rebounding after years of regulatory headwinds.

Wukong’s rapid rise is notable not just for its numbers but because it was wholly developed by a local studio, Hangzhou-based Game Science, in which Tencent holds an investment. Tencent also manages the game’s distribution on its WeGame platform. The success of Wukong is sparking renewed confidence in China’s ability to produce high-quality AAA games that can compete globally, potentially encouraging more such ventures.

As Tencent continues to gain attention due to its strategic moves in the gaming industry, it’s also entering a historically strong seasonal period. An analysis of the stock’s performance from August 20th to September 7th over the past 20 years reveals an impressive trend, with the stock delivering a striking +108.61% annualized return during this short window. Historically, this period has seen a 75% win rate, with 15 out of 20 years posting gains.

Looking at the chart, Tencent’s price is approaching a critical resistance zone around 391 , marked by a descending trend line that has held since the peak in early 2022. The price remains below the key trend line, suggesting that a breakout above 391 could be necessary to unlock further upside potential. Momentum indicators are mixed. The Average Directional Index (ADX) shows a reading of 22.26, indicating a trend that is gaining strength but isn’t fully confirmed yet. The Average True Range (ATR) sits at 21.26, signaling relatively stable volatility compared to recent months, which could be conducive for a breakout attempt.

Sign up here for thousands of more seasonal insights just waiting to be revealed!

Trade risks

- Previous seasonal patterns do not necessarily repeat themselves each year and China’s economic outlook remains uncertain – particularly it’s gaming sector.

Remember, don’t just trade it Seasonax It!