Seasonax’s seasonality feature can flag up some great event patterns. One of these events that is always good to look at is the turn of the month effect. Well known with stocks and indexes, but there can also be some interesting turn of the month reactions around currencies.

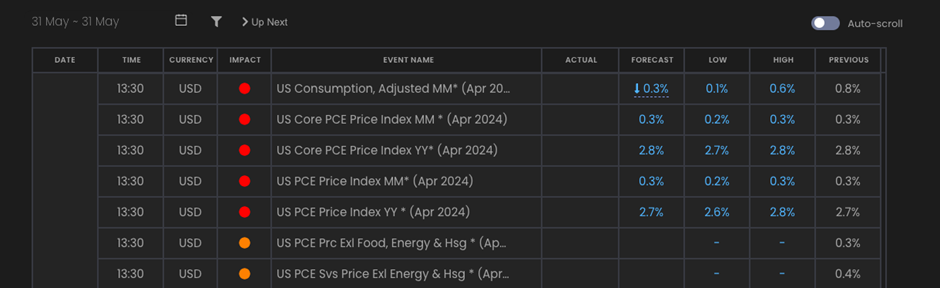

The EURUSD for example has an interesting event pattern around the start of June, which is also around the release of the Fed’s preferred measure of inflation, the PCE print at 13:30 UK time on Friday May 31. So, if we see a big miss in the PCE data to the downside on Friday, and a print below 2.6% y/y and 2.6% y/y for the core reading then markets will start to see more chances of lower US rates this year, which should lift the EURUSD pair higher. Over the last 15 years, around the turn of the month, the EURUSD pair has gained 80% of the time for a 0.61% return. The largest gain has been 2.85% and the largest fall -2.05%.

So, if we see a big miss in the PCE print on Friday watch for potential EURUSD gains! In terms of the expectations for the PCE print here is what’s expected below:

Sign up here for thousands of more seasonal insights just waiting to be revealed!

The major trade risk here is that prior seasonal patterns do not necessarily repeat themselves each year.

Remember, don’t just trade it Seasonax It!