The reasons for USD strength have been well documented this year as the Fed took a hawkish policy stance to control surging US inflation, and safe haven bids also boosted the USD. However, last week saw a big rise in USD short positions via the CFTC report as asset managers eye a peak in the USD.

Weak global growth, signs of US inflation falling, and the Fed’s statement surrounding allowing for monetary policy lag all mean that a slower rate of US rate hikes is ahead. The Fed may even soon pause. This gives a good chance for USD bulls to take profit and should weaken the USD as US rate expectations drop.

One key print to watch is the Fed’s preferred measure of inflation the PCE print due on December 01. A big miss there and this will increase expectations of a more dovish Fed when they meet in mid December.

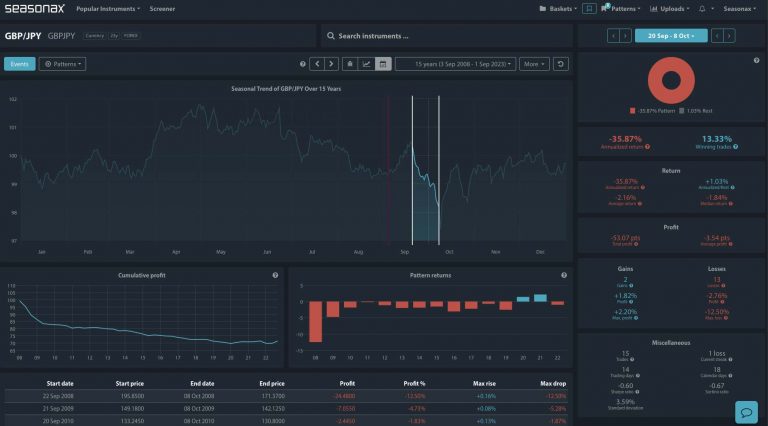

Note that Seasonax allows you to see major seasonal biases ahead. One such bias is the seasonal pattern in the USD. The USD tends to significant weakness in the second half of December. Does this mean a big US PCE miss on December 01 would be a great time to buy the EURUSD?

Major Trade Risks:

The major risk here is that US inflation keeps gaining higher which will likely keep the USD bought.

Remember, don’t just trade it, but seasonax it!