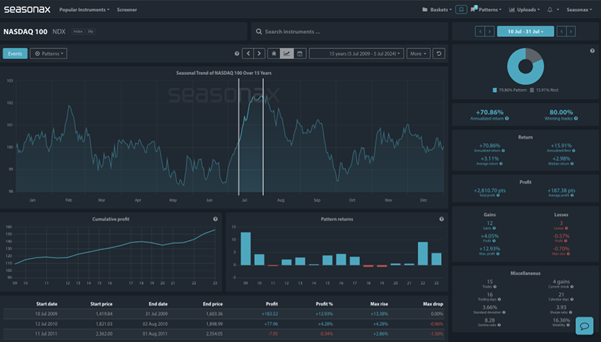

Instrument: Nasdaq

Percent move of instrument: 3.11%

Winning trade percentage: 80%

Start of seasonal pattern: July 10

End of seasonal pattern: July 31

The Nasdaq is heavily weighted towards technology stocks, and these tech companies often report strong earnings during the summer.

Companies such as Apple, Microsoft, Amazon, and Alphabet (Google) have fiscal quarters ending in June, with earnings reports typically released in July. Positive earnings reports can drive tech stock prices higher. Summer can also be a period of product launches and innovations in the tech industry. For example, Apple’s Worldwide Developers Conference in June has often stirred excitement in the past and can boost tech stocks. It occurred this year from June 10 through to June 14. You can see some of this year’s announcements here. So, will the latest US NFP report give investors confidence that a Fed rate cut in September is coming? Will this help the Nasdaq move higher again?

Technically, the Nasdaq is in a strong long term bull trend and the region below 19,000 is the major weekly support level from March highs where buyers would be likely to step in again should price fall to the area marked below.

Trade risks :

While these factors above can contribute to seasonal price increases, it’s important to note that the Nasdaq prices are not guaranteed to rise in July as there have been times when the Nasdaq has fallen.

Remember, don’t just trade it Seasonax It!