- Instrument Outlook: EUR/GBP

- Average Pattern Move: -0.18%

- Timeframe: 10 days post-UK CPI print

- Winning Percentage: 50%

Dear Investor,

You may not realize that UK inflation has remained stickier than many anticipated over the last few months, preventing the Bank of England from adopting a more dovish stance. As we approach the UK CPI release on March 26, historical patterns suggest that the pound has tended to hold firm post-inflation prints, pushing EUR/GBP lower. Given the latest CPI trend, we want to analyze the data in more detail.

UK CPI and Inflation Stickiness

UK inflation has been a persistent issue, with the latest January prints showing CPI at 3.0% y/y and Core CPI at 3.7% y/y. While both have declined from their 2023 peaks, the pace of disinflation has slowed, keeping market expectations for BoE rate cuts at bay. The data supports the view that services inflation and wage growth remain elevated, underpinning GBP strength.

EUR/GBP Seasonal Pattern Around UK CPI

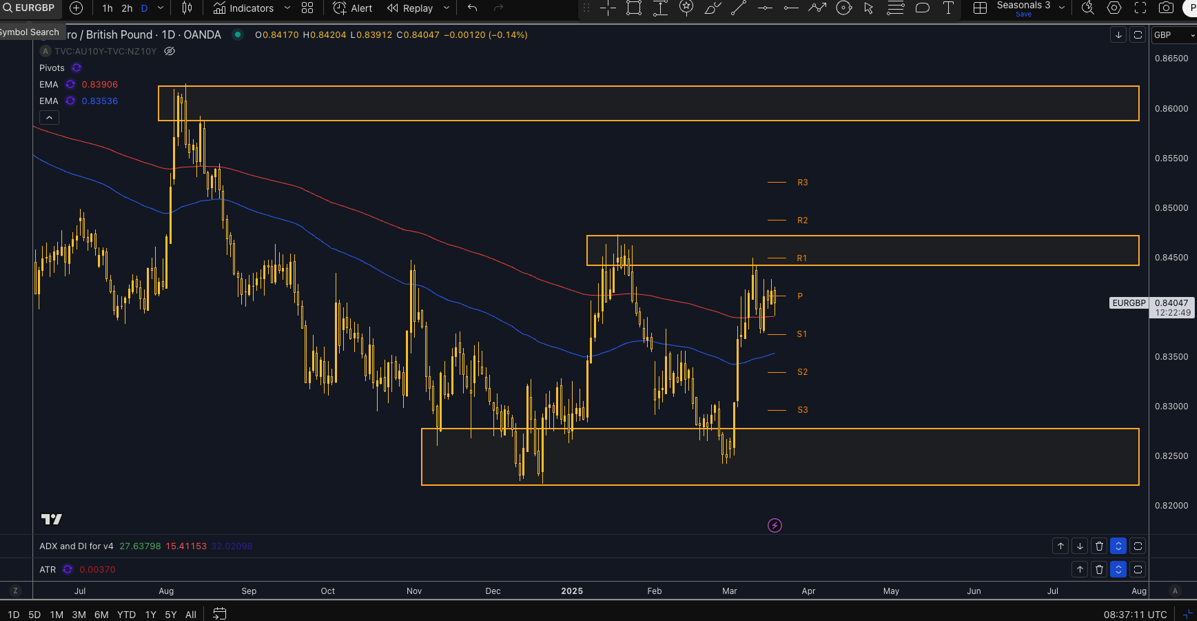

The chart below shows you the typical development of EUR/GBP around UK CPI releases. Over the past year, EUR/GBP has displayed a tendency to decline following the CPI event, averaging a -0.18% return over 10 days, with an even split of winning and losing trades. This suggests that markets have generally reacted to the inflation stickiness by maintaining stronger GBP positioning.

The reasoning is straightforward—persistently high inflation forces the BoE to maintain a restrictive stance for longer, leading to sustained GBP strength. By contrast, weaker inflation data could give room for speculation on earlier rate cuts, which would have the opposite effect.

Market Implications

- Sticky Inflation Supports GBP: If UK CPI remains elevated or beats expectations, GBP may strengthen as markets delay pricing in rate cuts yet again.

- Dovish Surprise Risks Upside for EUR/GBP: A downside surprise in inflation could accelerate expectations for earlier BoE easing, supporting EUR/

Technical Perspective

From a technical standpoint there is a major weekly support level at 0.8250 and resistance levels at 0.8450 and 0.8600. Expect those levels to be key for managing risk and looking for potential take profit areas.

Use Seasonax for your professional handling of market-moving events!

Sign up here for thousands more seasonal insights waiting to be revealed!

Trade Risks

The impact on EUR/GBP will depend on both inflation data and market positioning. A weaker-than-expected CPI reading could see markets quickly shift towards pricing BoE rate cuts, potentially breaking the seasonal pattern. Additionally, external macro factors, such as ECB policy shifts or broader risk sentiment, could influence EUR/GBP beyond UK inflation data alone.

Don’t Just Trade It – Seasonax It!