Mark your calendars for Wednesday, July 19! At 07:00 UK time, the much-awaited UK inflation data will be revealed.

Anticipations suggest that the headline figure will drop to 8.2% y/y from the previous 8.7%. However, the core reading is expected to remain stubbornly high at 7.1% y/y, aligning with its previous level.

Investors will be closely monitoring this release, seeking insights into how the UK is tackling its inflation battle.

With the core inflation still hovering three times above the Bank of England’s 2% target, there is significant work ahead. Should the core reading dip below economists’ minimum projection of 6.6% y/y, brace yourself for rapid GBP selling.

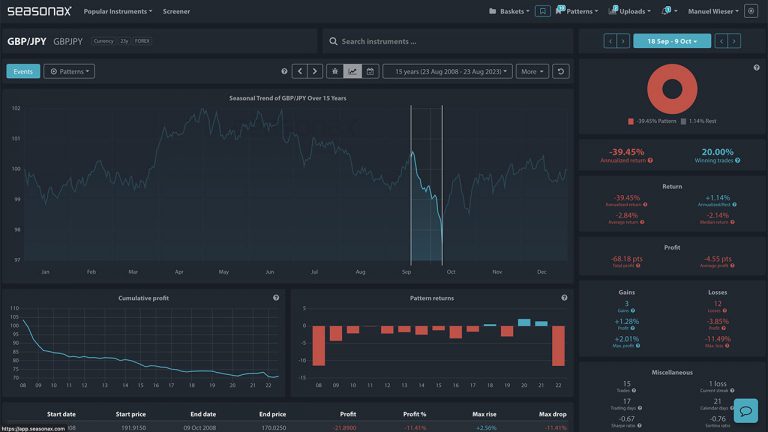

In particular note the strong seasonal bias in the GBPJPY pair. Over the last 15 years the GBPJPY pair has fallen 80% of the time for an average return of -1.61%.

The maximum fall has been over 5% in 2008 and the maximum fall within the seasonal pattern has been over 7% in 2016. So, will the GBPJPY fall again this year between July 17 and August 26?

Major Trade Risks:

Remember, that previous seasonal patterns do not necessarily play out every year, and don’t forget that BoJ policy will also impact this outlook as well as UK inflation data.

Remember don’t just trade it, Seasonax it!