Dear Investor,

Elections will take place in the USA on November 5th. In the media you can read a lot about the candidates Kamala Harris and Donald Trump.

Certainly the political side is very important. But for you, as an investor, it is also important to consider how the markets behave during the elections.

That’s why I want to address this question for you today: How do stock prices typically perform in the days before the US election, and in the days after?

The election influences the stock market!

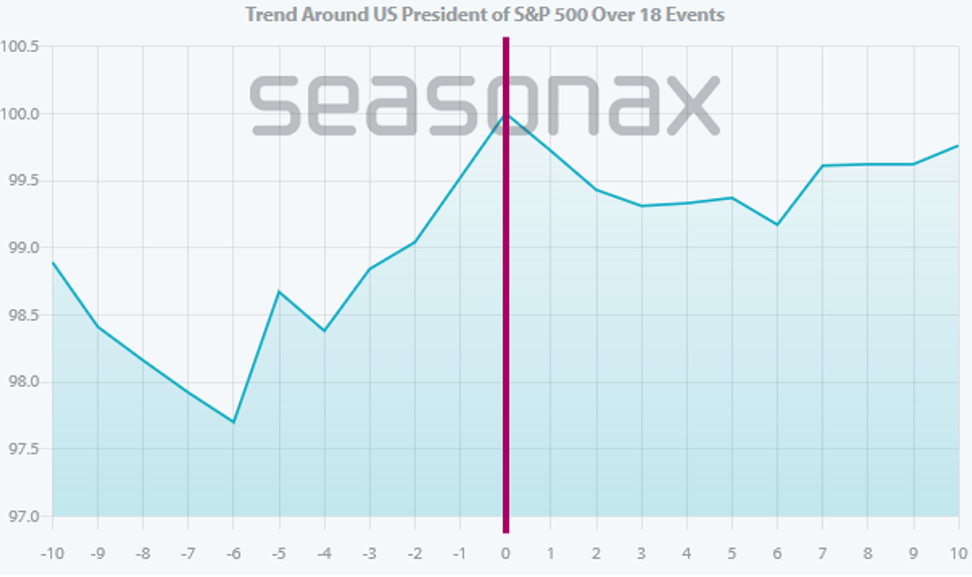

Take a look at the event chart below. It shows you the average performance of the S&P 500 in the ten trading days before and after election day in the last 18 US elections.

The red line in the middle marks election day.

From this you can see at a glance how US stock prices performed around election day.

Average performance of the S&P 500 10 trading days before and after the day of the US presidential election (1950 to 2023)

In the six days leading up to the election, the S&P 500 rises, then falls. Source: Seasonax

As you can see here, median stock prices rose for six days leading up to the US election. However, immediately afterwards, prices reversed for six days.

The reason for this development is probably the following: Before the election, many people are optimistic, they hope that their candidate will be elected and that the situation will improve.

This has an impact on prices.

After the election, at least some voters are disappointed.

This also has an impact on the prices.

83% hit rate!

The numbers are impressive: In all elections since 1950, in 15 out of 18 instances, the S&P 500 rose in the six days leading up to the election. That corresponds to a high hit rate of 83%!

The increase was an average of 2.35%. That amounts to 161.29% for the year – what more could you want as an investor?

But, is it perhaps a coincidence?

The fact that the price changes exactly on election day suggests that the election actually creates this pattern. In addition, there are similar patterns in other countries.

The pattern also exists in other countries

A similar pattern can be seen in Germany, for example, in the federal elections. I investigated this many years ago and published an article for the “Financial Times Deutschland”. At least five other business and financial newspapers, such as the “Handelsblatt”, took up the topic at the time.

That was a lot of work back then. Seasonax didn’t exist yet. I programmed everything myself and didn’t just input it into a spreadsheet. It was also a pioneering achievement – as far as I know, no one had previously known about this connection between the prices around election day.

However, now you can carry out these and many other tests yourself with just a few clicks in Seasonax.

What progress!

How to use event studies

To examine an event, first pull up a seasonal chart for a particular instrument such as the S&P 500.

At the top left you will find the button labeled “Seasonality”, which after clicking, will offer you the option “Events”.

Screenshot, excerpt, from Seasonax

The events are easy to find. Source: Seasonax

Select the event that interests you personally, such as the US election, from the drop-down menu.

As is usual with seasonality, you can then mark a time period and look at the key figures for return, risk, etc.

You don’t have to do anything more.

This way you get all the information you need to improve your trading further. Good luck!

Kind regards,

Dimitri Speck

Founder and Chief Analyst of Seasonax

PS: I’m happy for you when you make profits with Seasonax!