US oil has some mixed drivers right now.

The OPEC+ production cuts had been providing some support for oil alongside a weaker USD. Furthermore, the announcement of a 16 point property support plan for China could prop up more expectations of rising demand. Furthermore, according to Energy Intel, OPEC+ may discuss adjustments to member’s oil production baselines in early December as many are struggling to meet their agreed quotas.

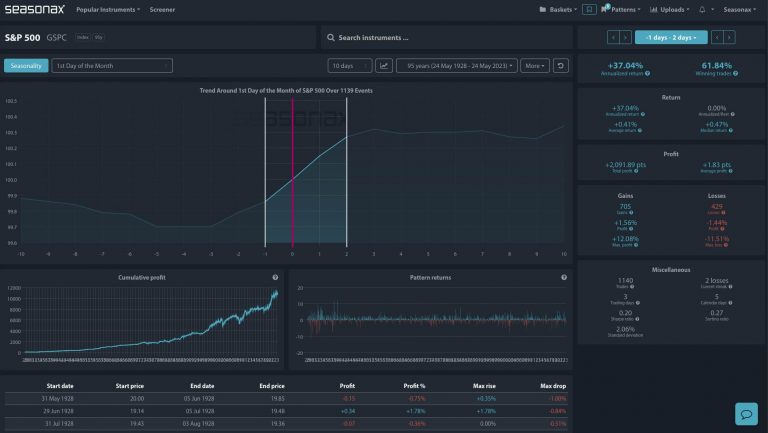

However, as we head into year end it is worth noticing oil’s weak seasonal pattern that has favoured selling throughout October and November.

Should these mixed messages keep investors cautious on oil with so many mixed drivers?

Savy investors will keep in mind the weak seasonals and realise that if the fundamentals favour selling then the seasonals could give them an extra push lower

Major Trade Risks:

The main risk here is that oil is boosted higher by OPEC+ policy shift.

Remember, don’t just trade it, but Seasonax it!