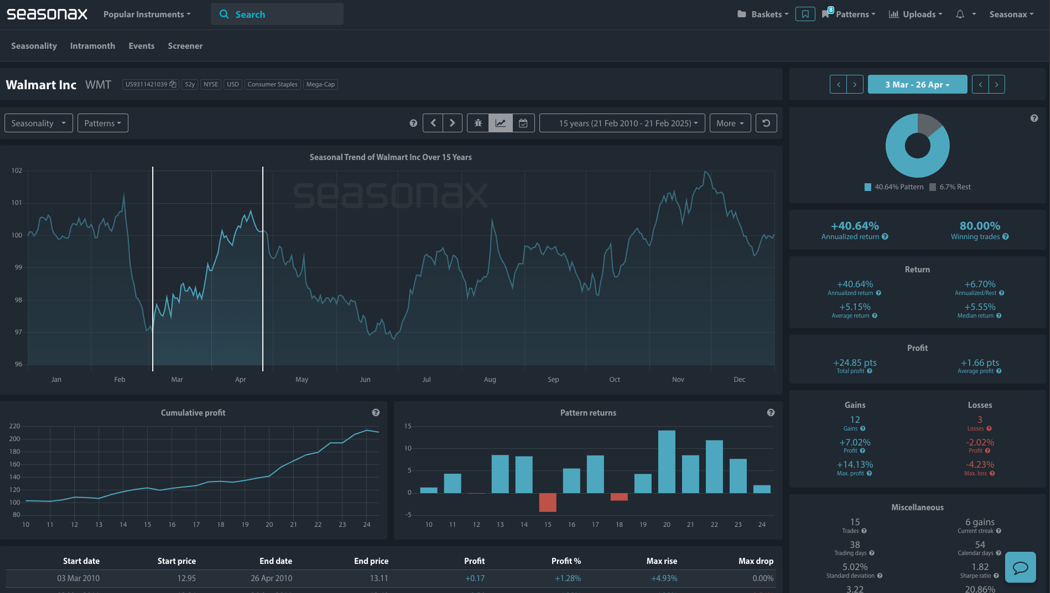

- Instrument: WMT (Walmart Inc.)

- Average Pattern Move: +5.15%

- Timeframe: March 3 – April 26

- Winning Percentage: 80%

You may have heard that Walmart’s latest earnings disappointed on the profit outlook, reflecting ongoing economic and geopolitical challenges. However, CEO Doug McMillon and CFO John David Rainey remain optimistic about consumer resilience and Walmart’s ability to adapt. With a focus on digital transformation, store modernization, and expansion into premium offerings, Walmart is navigating a changing retail landscape while maintaining its value-driven appeal. Walmart’s CFO highlighted that U.S. consumers remain engaged, especially in the value segment. This could support revenue stability even in an uncertain macroeconomic environment. Given this backdrop, we want to analyze the seasonal data in more detail.

Walmart’s Seasonal Strength from March to April

The historical performance of Walmart’s stock shows a strong seasonal bias from early March to late April. Over the past 15 years, the stock has posted an annualized return of +40.64% during this period, with 80% of trades ending in gains. This suggests that, despite short-term earnings concerns, Walmart has a strong tendency to perform well in the coming months.

The chart below shows the typical price development of Walmart during this seasonal window:

- Cumulative Profit Trend: Over time, Walmart’s stock has demonstrated a consistent upward trajectory in this timeframe.

- Pattern Returns: Positive returns dominate, reinforcing the seasonal bullish trend.

Technical Perspective

From a technical standpoint there is a strong daily support area around the 90 region which is also in line with a test of the 100 EMA.

Given the strong seasonal tailwind, will Walmart’s stock rally despite profit concerns?

Use Seasonax for your professional handling of market-moving events!

Sign up here for thousands more seasonal insights waiting to be revealed!

Trade risks

Labor costs, supply chain disruptions, and possible tariff implications remain headwinds.

Don’t Just Trade It – Seasonax It!