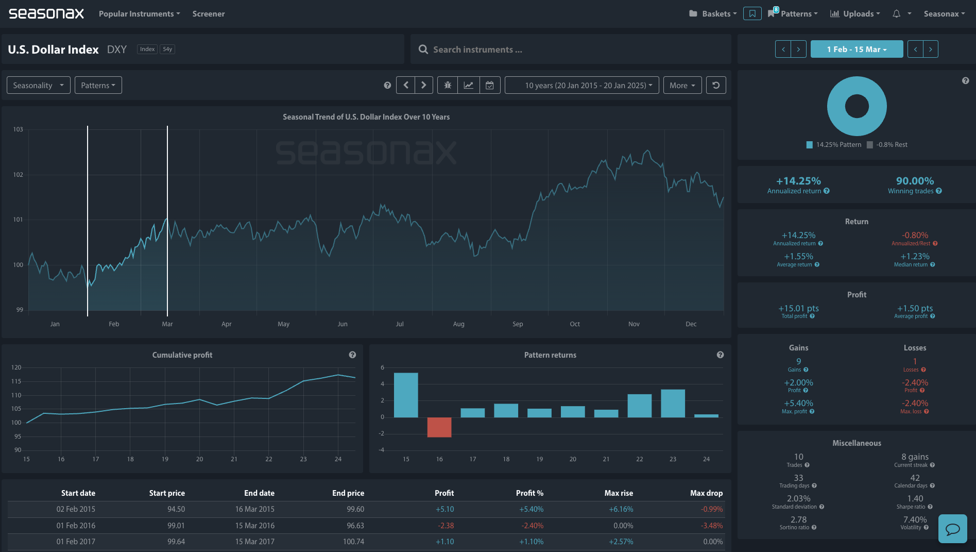

Instrument: DXY

Average Pattern Move: +1.55%

Timeframe: Feb 01-Mar 15

Winning Percentage: 90%

As President Donald Trump begins his second term, analysts anticipate his policies will have significant effects on the U.S. dollar (USD). Currency speculators are showing strong support for the dollar, marking the most bullish stance since 2016. In his inaugural address, President Trump emphasized imposing tariffs on foreign countries to benefit U.S. citizens. However, although he did not announce specific tariff measures, which led to a 1.3% decline in the U.S. dollar index, he has now announced that he is thinking of 25% tariffs on Mexico and Canada from February 01.

So, the future of the USD largely comes down to the new administration’s fiscal and trade policies. If Trump does go ahead with tariffs then further USD gains are reasonable.

Seasonal Strength

The seasonal analysis of the U.S. Dollar Index (DXY) over the past 10 years shows a consistent upward trend between February 1st and March 15th, with an annualized return of +14.25% and a high winning trade ratio of 90%. The cumulative profit graph indicates steady growth during this period across most years, with an average profit of +1.55%. Only one year recorded a loss during the period, highlighting the pattern’s reliability. The Sharpe ratio of 2.10 and Sortino ratio of 2.78 indicate strong risk-adjusted returns, while the low standard deviation of 2.03% underlines the strategy’s stability. This trend suggests a favorable seasonal opportunity for the DXY during this timeframe.

Technical Perspective

A look at the DXY on the daily chart shows that price is trying to put in support around the re-test of the daily trendline drawn from the September 30th and December 06 swing points marked on the daily chart below. This would be a great place to omit risk with stops under the Jan 20th low sub 108.

Sign up here for thousands more seasonal insights waiting to be revealed!

Trade risks

The outlook for the FTSE 100 is tied to the outlook of the UK economy which is particularly fragile at the moment.

Don’t Just Trade It – Seasonax It!