American Express (AXP) is a global integrated payments company known for its financial services, including credit card issuance, payment processing, and merchant acquiring. American Express is known for attracting high-spending customers, particularly in the travel and lifestyle sectors, offering premium products and services.

It’s earnings report is scheduled this week for July 19 and analysts are predicting earnings per share (EPS) of approximately $3.24, alongside expected revenue of around $16.59 billion. This would mark a continued trend of growth, as American Express has reaffirmed its full-year guidance, anticipating revenue growth of 9% to 11% and EPS in the range of $12.65 to $13.15 for fiscal 2024. In recent quarters, the company has consistently outperformed expectations, which has contributed to its strong stock performance this year. However, a disappointing earnings release could leave the stock vulnerable to a correction lower.

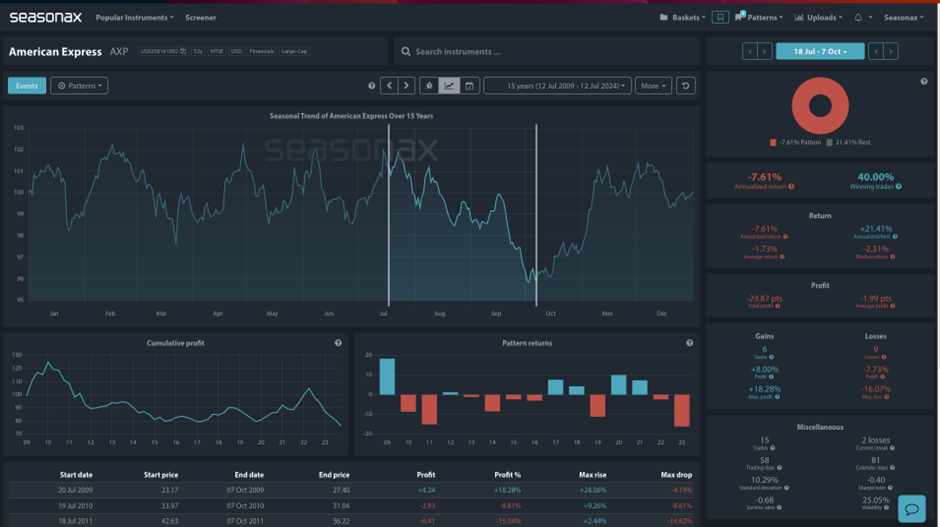

Over the last 15 years American Express has shown a period of seasonal weakened and losing trades of 60% for an average fall of 1.73%. The largest falls have been in 2023, 2019, and 2011, with falls of 16.07%. 11.15% and 15.04% respectively. So, do watch out for a surprise miss in earnings to potentially send the share price lower.

Technically, American Express shares have been in a strong uptrend, but the broken weekly trend line shows the first possible sign of a trend reversal on the break on June 03. Will 250 prove to be a top in share prices for now if earnings disappoint on Friday?

Sign up here for thousands of more seasonal insights just waiting to be revealed!

Trade risks

- Remember, previous seasonal patterns do not guarantee future seasonal patterns performance and the earnings release will be highly influential on the share price as well as Fed policy.

Remember, don’t just trade it Seasonax It!