Going into this Fed interest rate meeting market expectations are that the Fed will hike by 25bps.

Short term interest rate markets are pricing in a 95% chance of a 25bps hike to 5.125%. However, the forward guidance is going to be the key focus for this meeting. So, do the Fed see rate cuts coming this year? Or will they affirm their hawkish stance to bring down US inflation?

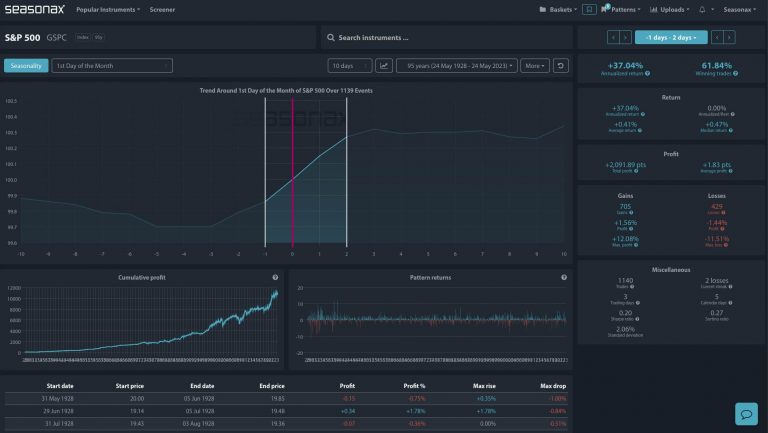

Look at the seasonal reaction to the S&P500 to help gauge a market strategy for this FOMC meeting.

Over the last 25 years, when the Fed hikes rates, the S&P500 has risen into the event, but then sold off in the days afterwards. So, if the Fed do take a more hawkish stance in their forward guidance watch out for sharp selling in the S&P500!

Major Trade Risks:

The major trade risk here is that the Fed announce a hike, but then signal rate cuts to come. However, note that this response is already priced into the markets with two rate cuts expected by STIR markets

Remember, don’t just trade it, but Seasonax it!