Dear Investor,

If you are a sports fan, you are probably already looking forward to the date: on July 26, 2024, the next Summer Olympics will begin in Paris. Athletes from all over the world will compete in thousands of events. Nearly ten million tickets will be on sale.

But the date should also be of interest to you as a shareholder. Significantly, the share prices of the host country, in this case France, have a special development ahead of them.

Do international sporting events influence the markets?

Since the Olympics only take place every four years and are therefore relatively infrequent, the World Cup, which is also very important internationally, has been included in this analysis. This gives a higher statistical significance.

Football World Championships and Summer Olympics are held every four years, staggered by two years. Since 1960, there have been 16 Summer Olympics and 16 Football World Cups.

I took the 2002 World Cup into account twice because it was held in two countries, Japan and South Korea. On the other hand, the 2020/21 Olympics in Japan had to be omitted because it was postponed due to the pandemic during the period under review. In addition, daily prices of the respective stock markets are not available for some countries at the time of hosting. In total, 24 stock markets could be considered for 32 sporting events. For standardization, and because of its relevance for international investors, this study is conducted on a U.S. dollar basis.

This list shows the countries considered for this event study:

List of countries considered

24 countries could be considered for the event study. Source: Seasonax

How do prices develop one year before and after a sporting event?

To examine the impact of sporting events, we look at the stock market performance around the event in the countries where the sporting event takes place. We thus set a temporal anchor, since the games take place at different times of the year.

The start of the sporting event is set as such an anchor. Then the average of the returns around this time is calculated. This shows at a glance the typical progression around major sporting events.

The result of the Event Study at a glance!

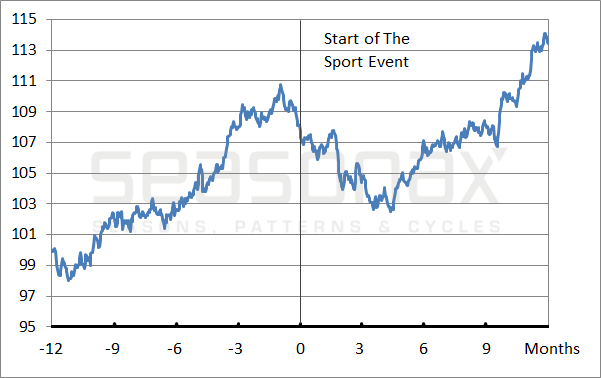

The next chart thus shows the average performance of the indices of all the countries concerned.

The vertical scale provides the percentage information on how much the stock indices rose or fell on average. The horizontal one shows the time before and after the start of the sporting events.

In the middle is the beginning of the major sporting event. Before that, the course of one year is entered, followed by another year. In total, a period of two years is shown. The chart thus shows you the typical development of all the stock indices of the respective country around the major sporting event.

Mean development of 24 country indices one year before and after the start of the Olympics or World Cup

In the run-up to international sporting events, shares rise! Source: Seasonax

As you can see, stocks typically began to rise about eleven months before the start of sporting events. On average, the increase was 13.01%.. Annualized, that’s a tidy 15.33%!

However, on average, at least a month before the opening a decline in prices began. So the games themselves can no longer boost share prices!

The course around Olympiads

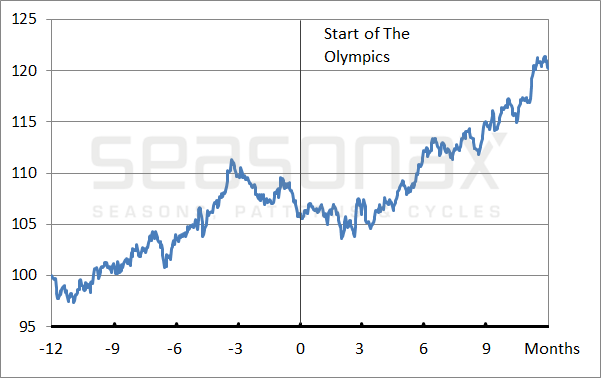

The first chart included Olympics and World Cups because of statistical significance. But what about the Olympics in particular? After all, it is the Summer Olympics that will be held in Paris in 2024.

The next chart shows the average development of the indices of the countries concerned twelve months before and after the start of the Olympics.

Mean development of 12 countries’ indices one year before and after the start of Olympiad

In the run-up to international sporting events, shares rise! Source: Seasonax

As you can see, stocks also rose for the Olympics about eleven months before the opening. However, the rise ended three months before the Games began. In the months around the Games, therefore, there was again a period of weakness.

Reasons for the influence of the Games

What are the reasons for this pattern? The Olympics and soccer World Cups boost economic development through tourism and infrastructure measures, among other things. For the 2006 World Cup in Germany, for example, economists at Deutsche Bank estimated the contribution to growth at a quarter of a percentage point.

In addition, such a major event attracts a great deal of international attention. This attention apparently prompts shareholders and asset managers to look more closely at the shares of the country in question.

So there are reasons for a rise in the stock market, but they have an impact some time before. It is worth turning to the country in question almost a year in advance.

The downward trend around the games is probably best interpreted as a technical correction to the previous rise.

France’s stock market could be the winner of the Olympics!

Probably in contrast to the expectation of many market observers, sporting matches do not fire share prices around the sporting event. During that time, shares tend to fall.

The anticipation is all the greater for it. Already from about eleven months before the start of the Games, the shares of the country concerned rise!

As you can see once again, a precise analysis of events can pay off for investors. Seasonax helps you with that!

Warm regards,

Dimitri Speck

Founder and Head Analyst of Seasonax

PS: Use Event-Studies!