The Bank of England meet on Thursday and there are signs of disinflationary forces are already at work.

UK headline and core inflation has been falling from October highs of last year, so the BoE may be inclined to hold rates on Thursday in light of the recent Bank crises from the US and Europe.

If the BoE cut rates then it would be reasonable to expect the EURGBP pair to gain.

From an events perspective the EURGBP tends to gaining the following week after the Bank of England meet and cut rates. Now they are not expected to cut rates, but would some dovish forward guidance from the BoE have the same effect as a cut?

If the BoE do conduct a dovish hold then it would not be unreasonable to see the EURGBP gain on such a decision. In this case the reaction of the EURGBP to a BoE rate cut is a handy reference point in the current market conditions.

Major Trade Risks:

The major trade risk here would be if the BoE maintain their rate hiking stance and feel more work needs to be done surrounding inflation

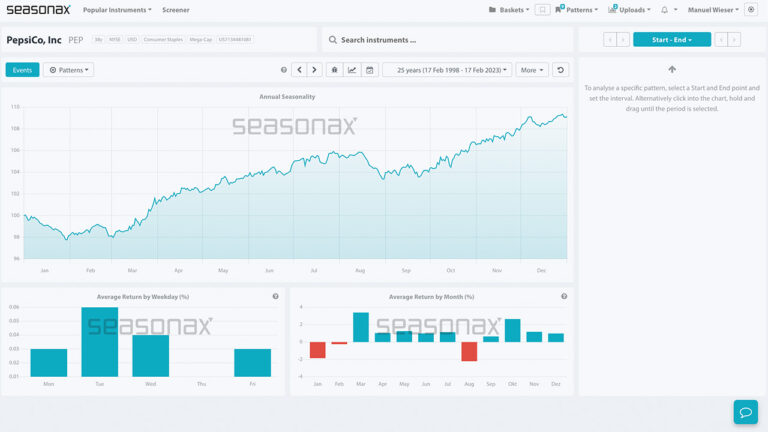

Remember, don’t just trade it, but Seasonax it!