The Federal Reserve are expected to hike rates by 75 bps tomorrow and STIR markets see a 75%+ chance of a 100 bps hike. The strength this year of the USD has been one of the key reasons for gold’s recent falls. Tomorrow the Federal Reserve could send the USD lower if they start to stress growth concerns over and above inflation worries.

If this happened then gold could put in a strong recovery. It is particularly noteworthy to see gold’s strong seasonal pattern at the moment.

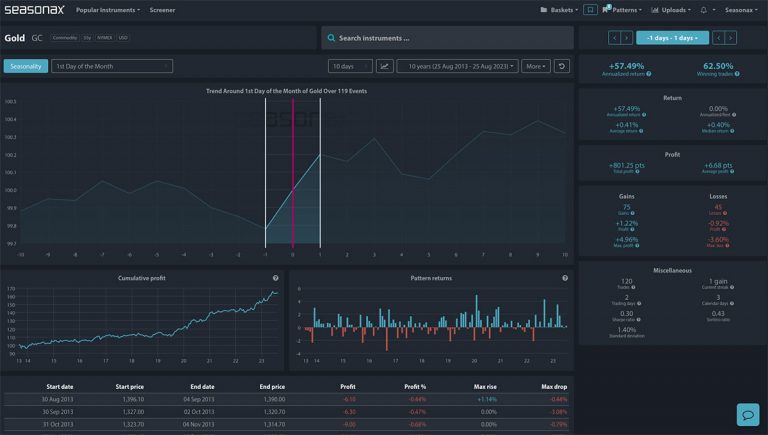

Over the last 10 years gold has gained eight times between July 26 and August 28. The largest gain was +9.15% in 2019 and the largest loss was in 2018 at -0.99%. The average return has been +2.98% and the average positive return has been +3.98%.

Will the Fed send gold prices higher tomorrow?

Major Trade Risks:

If the Fed continue to stress tackling inflation, even at the risk of stifling growth, then the USD could still strengthen and that could weigh on gold prices.

Analyse these charts yourself by going to seasonax.com and get a free trial! Which currency pair, commodity, index, or stock would you most like to investigate for a seasonal pattern?

Remember, don’t just trade it, Seasonax it !