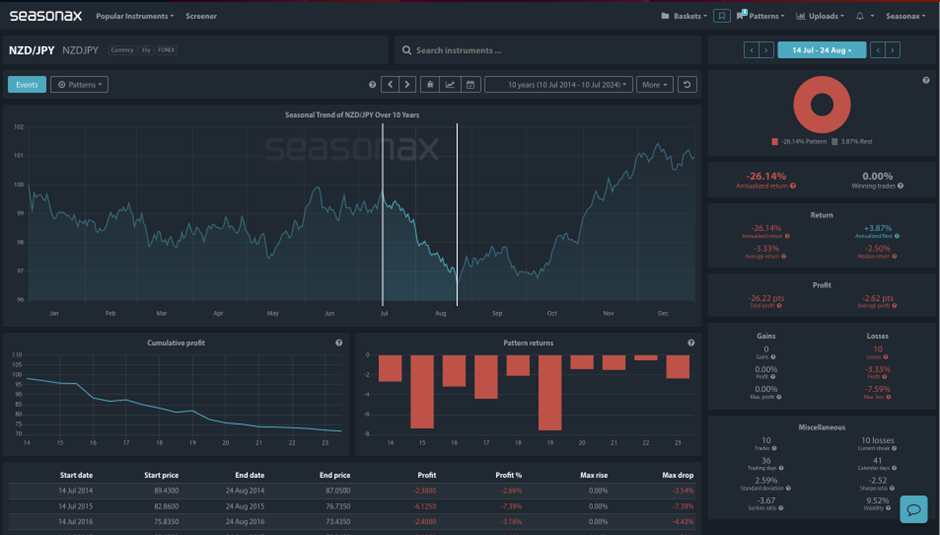

There is a strong seasonal bias for the NZDJPY coming up. Over the last 10 years the NZDJPY has lost value every single time between July 14 and Aug 24. In fact, the maximum gain within this time period has only ever been 1.75% (in 2020). So, could a weak CPI print out of New Zealand on Tuesday at 11:45 UK time send the NZDJPY sharply lower? The RBNZ took a dovish tilt last week and STIR markets now see 50% chance of a rate cut on August 14.

Traders and investors often reassess their portfolios during the summer, leading to reduced risk appetite. The Japanese yen (JPY) is considered a safe-haven currency, meaning it tends to appreciate during periods of risk aversion as investors move away from riskier assets like the Australian dollar (AUD). Furthermore, the Bank of Japan is now increasing its interest rates, so a sharp move in higher rates could suddenly add to JPY strength.

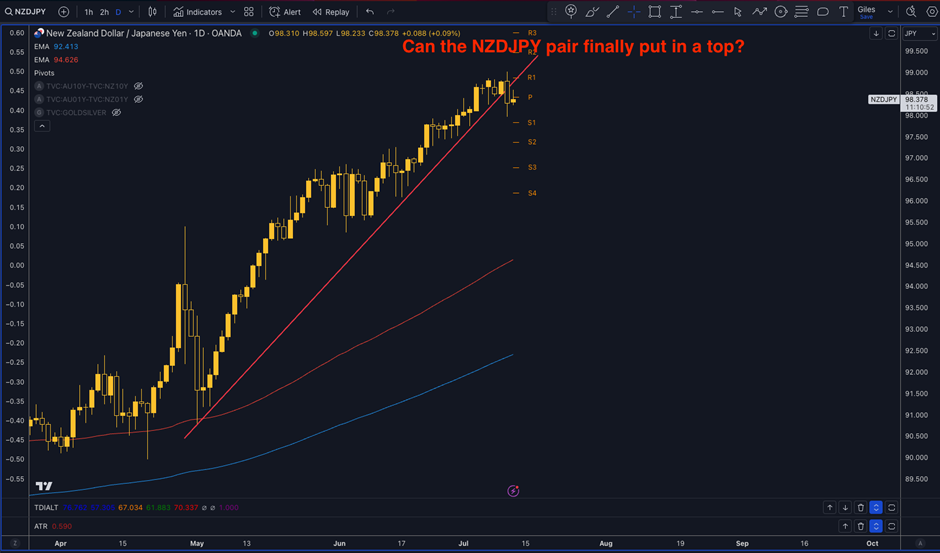

Will we finally see a top in the NZDJPY? Can this strong seasonal pattern play out for the NZDJPY this year?

Sign up here for thousands of more seasonal insights just waiting to be revealed!

Trade risks

- Previous seasonal patterns do not guarantee future seasonal patterns performance.

Remember, don’t just trade it Seasonax It!