I am often asked how one can make the most of seasonal trends in one’s actual investment practice.

I get acquainted with a wide variety of investment styles in this context.

The good thing is that regardless of whether one is a day trader or a long-term investor, whether one trades commodities or stocks, whether one is already successfully implementing another investment strategy or is just starting out: there is a seasonal strategy that will help improve one’s investment results.

Today I would like to show you how to optimally use seasonality and if so desired, integrate it into already existing trading strategies.

The following list of seasonal trading strategies is drawn from investment practice. The boundaries between these five seasonal investment strategies are therefore fluid:

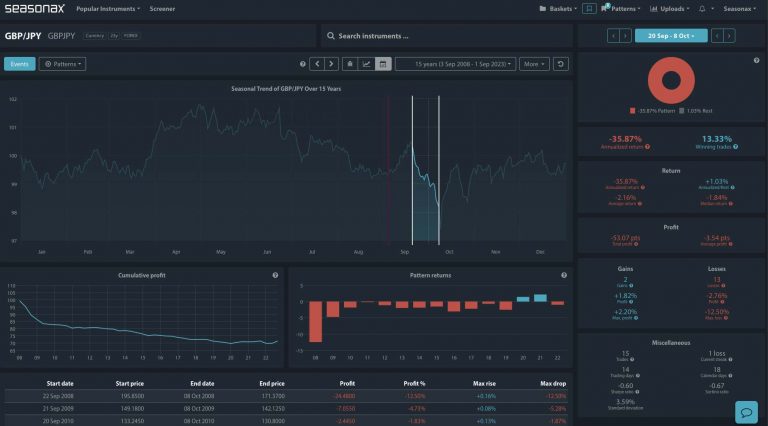

Seasonal Strategy 1: Using Seasonal Patterns Directly

This strategy is probably the most obvious: one buys an instrument at the beginning of its positive seasonal phase and sells it at its end, for example an instrument on a stock index at the beginning of the Christmas rally in mid-December to early January. The Seasonax Screener can be of great help in finding patterns upcoming in the near future. Keep in mind in this context that seasonality can increase the probability of generating gains, but just as any other investment strategy, it does not always work. Thus one should cap the size of individual investments, diversify and set stop loss levels as well.

Seasonal strategy No. 2: Timing

Occasionally I hear from long-term investors that while they are convinced of seasonality, they don’t use it due to the short window of opportunity. Seasonal patterns are necessarily only a few months long and thus short relative to e.g. an investment horizon of three years.

Fortunately long-term investors can nevertheless also take advantage of seasonality: namely, by optimizing their timing! For example, one can bring forward a sale when a seasonal downtrend is imminent, place one’s buy orders at intermediate seasonal lows, or schedule profit-taking precisely in advance based on seasonality.

Seasonal strategy No. 3: Filtering

In a way, this method is a counterpart to the previous one: it provides short-term investors with the opportunity to benefit from longer-term seasonal patterns. The well-known successful trader Larry Williams (and developer of the Williams %R indicator) has popularized this method early on. When using the seasonal filter strategy, one does not enter into a position against a strong seasonal trend.

E.g. the euro is seasonally strong against the US dollar in December, and a short position should therefore not be taken at that time. The seasonal filter strategy reduces the number of trades, but can greatly increase the probability that individual trades will generate a profit.

Seasonal strategy No. 4: Additional input

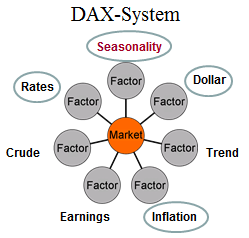

Most investors make their decisions based on several input factors. The following diagram shows a selection of possible input factors for trading on the German stock market:

Possible input factors for trading decisions

Seasonality complements existing systematic approaches well. Source: Seasonax

As you can see, I have highlighted the four input factors “interest rates”, “seasonality”, “dollar”, and “inflation”.

Why am I doing this? The best timing system for the German stock index DAX I am aware of – the Gebert system with a track record since the 1990s – is based on these four factors:

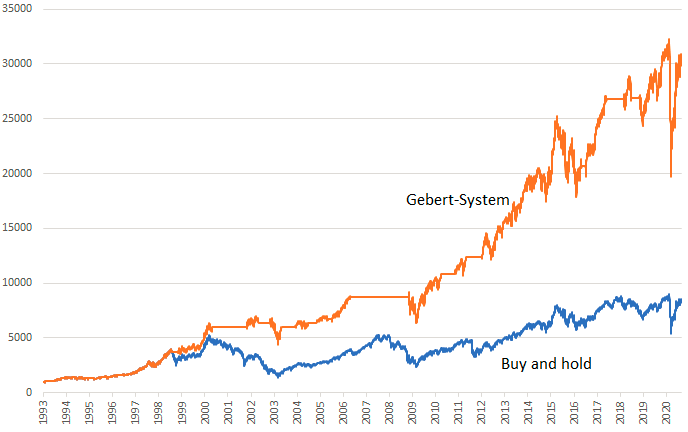

Gebert-system, DAX

Seasonality complements well existing systematics. Source: Seasonax

As you can see, the Gebert system beats the DAX by a significant margin. This demonstrates that it is possible to profitably integrate seasonality into existing decision models.

This method is suitable for all investors who already use a successful investment strategy and are therefore not interested in alternative approaches, but only in further improvements.

In short, one can basically continue using one’s current investment strategy if one simply regards seasonality as an additional decision factor – and thereby boost one’s profits!

Seasonal Strategy No. 5: Instrument Selection

Ever since Seasonax has the Screener which lists the currently most promising seasonal patterns from a variety of instruments at the push of a button, selection is one of my favorite applications of seasonality.

I find it especially useful with equities, as the number of selections available is particularly large.

However, screening can also be applied to other instruments, such as commodities or currency pairs.

Selection entails choosing particularly promising instruments for the coming weeks or months – depending on the investment horizon. This can e.g. be the ten seasonally most promising stocks in the S&P 500 Index or another stock index.

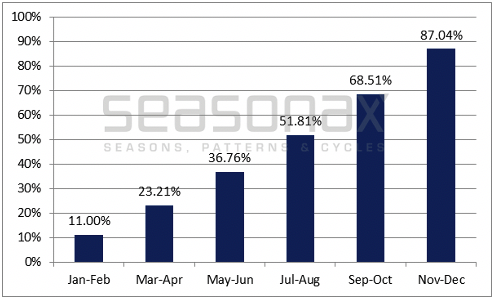

At the end of the seasonally interesting phase, the then seasonally most promising stocks are selected. The idea behind this is to be invested in the most promising instruments at any given time of the year. Thus one first invests in one group of seasonally attractive stocks, then in the next group, and so on. Ideally, the returns then cascade, as illustrated schematically below.

Cascading seasonal returns, schematic

Cascading helps increase yield. Source: Seasonax

Of course, in reality the stock market does not move with such regularity. One can therefore also switch shares individually, as all of them exhibit individual seasonal patterns. That way returns can be boosted to an even greater extent.

The fastest way to find the most promising stocks – or other instruments – is to use the Screener in the Seasonax app!

The fastest way to find the most promising stocks – or other instruments – is to use the screener in the Seasonax app!

5 Seasonal Strategies for You!

I hope to have given you an idea with this overview of how you can best use seasonality to your benefit.

Simply choose the seasonal investment strategy that works best for you from the five strategies presented. For optimal investment success, an investment strategy does not only have to be good – it should also be compatible with your style!

Yours sincerely,

Dimitri Speck

Founder and Head Analyst of Seasonax

PS: Use the seasonal strategy that is most suitable for you!