Dear Investor,

You have probably already become aware from media reports that global stock markets plummeted last week, for instance the S&P 500 Index lost 11.49 percent.

The catalyst was the corona virus epidemic, which is spreading in Italy, South Korea and gradually also in the US and Germany, with case numbers rising much more rapidly than was generally expected.

Such sharp declines serve as a useful reminder that stock prices not only go up, but occasionally happen to go down as well.

As an aside, in this issue of Seasonal Insights I will not specifically recommend going short at the current juncture, i.e., to bet on falling stock prices – as such a strong slump is often followed by a sizable counter-trend move.

Nevertheless, I do want to show you today how you can benefit from seasonality in times of declining stock prices.

Trade both market directions with the help of seasonality!

There are both seasonal uptrends and downtrends. If it should become necessary, you can therefore use seasonal patterns to analyze and trade the stock market in both directions. Thus you can take advantage of the opportunities offered by any type of market trend.

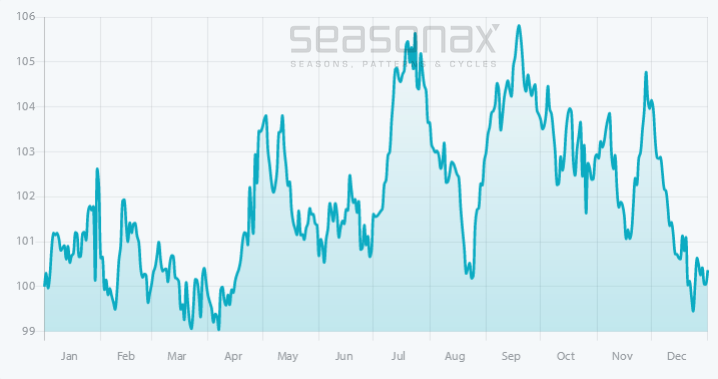

First I want to show you the seasonal chart of Office Depot, a stationary supplier. The seasonal chart below shows the average moves in the stock of Office Depot in the course of a calendar year over the past ten years.

Office Depot (ODP), seasonal pattern over the past ten years

Office Depot typically declines from mid February until the end of August

Source: Seasonax (click here to analyse the pattern)

As the chart illustrates, there has been a seasonally weak time period, which I have highlighted in blue – after all, we are discussing short sales.

Short positions: mental inversion required!

When selling a stock short, all figures shown by the Seasonax app have to be inverted, as it essentially shows only the results for long positions.

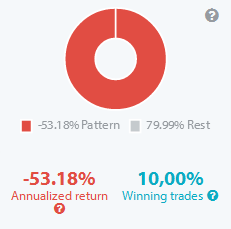

Consider in this context the annualized return and the percentage of winning trades for Office Depot in the chosen time period of February 18 to August 24 as shown by Seasonax:

Office Depot, annualized return and winning trades

What appears to be an unfavorable result is actually good for short positions – and vice versa!

Source: Seasonax (click here to analyse the pattern)

As a short position is under consideration, one has to mentally invert the figures shown above. The strongly negative annualized return indicates that a short position would have generated a large gain in this time period. 10% winning trades for long positions implies that for short positions the rate of winning trades would actually have been 90% (=100%-10%).

As you can see, Seasonax is just as well-suited for identifying shorting opportunities. Thus you will be well prepared to cope with all market phases!

Make use of the detrending feature!

Most stocks have been rising in recent years. As a result of this, it appears as though there are relatively few patterns of falling prices. A stock such as Amazon, which has advanced relentlessly in recent years, displays only very few phases of seasonal weakness.

We have remedied this problem with the so-called “detrending” function. Click on the chart symbol  above the seasonal chart in the Seasonax app, and a detrended version of the chart will appear.

above the seasonal chart in the Seasonax app, and a detrended version of the chart will appear.

This means that the over-arching uptrend will be subtracted out. Thereafter you will immediately and quite clearly discern in what time periods the relatively weak phases are located. The following two charts illustrate the difference.

Amazon (AMZN), seasonal pattern over the past 10 years

The seasonal pattern chart shows a quite steady, uniform advance

Source: Seasonax

Amazon (AMZN), detrended seasonal pattern over the past 10 years

On the detrended chart, periods of seasonal weakness can be recognized quite well

Source: Seasonax

As the comparison demonstrates, detrending visually amplifies seasonal trends. As a result, periods of seasonal weakness can be easily discerned at a glance.

Thus this function enables you to quickly identify the weakest and therefore prospectively most profitable phases for short sales in stocks or commodities that were predominantly rising in recent years.

Take advantage of the extended functions of Seasonax!

Seasonax cannot make stock prices go up. However, we can provide you with the tools that will enable you to reap the greatest possible benefit from every type of market cycle.

Give extended functions such as detrending a try at www.app.seasonax.com right away!

PS: at www.app.seasonax.com you can discover profitable patterns for all market phases!